Look for trends and values to focus on as Delta Airlines prepares for Q4 earnings

As Delta Air Lines prepares to report fourth-quarter earnings, investors are looking closely at how the carrier is coping with ongoing cost pressures and changing demand conditions. The company’s strong performance in 2025 boosted investor confidence, and the stock has made steady gains since mid-year. Delta is relying on its pricing power and effective cost management to sustain recent momentum.

Measurements

In a recent statement, management said it expects fourth-quarter earnings per share to be between $1.60 and $1.90, and an operating margin between 10.5% and 12%. Earnings forecasts are above Wall Street forecasts of $1.55 per share, compared to $1.29 per share in Q4 2024. Analysts are looking for $15.77 billion in revenue for the December quarter, which represents a 1.4% year-over-year increase. The company is expected to report fourth-quarter earnings on January 13, before the opening bell.

Delta shares have grown nearly 40% in the past six months and hit a new record last week. The stock outperformed the S&P 500 during that time and is trading above its 52-week moving average of $56.13. Analysts are generally optimistic about DAL’s prospects, most of them conservative Buy it ratings from this week. The momentum is expected to continue in fiscal year 2026, supported by healthy demand, especially in the domestic market, due to the company’s continued focus on the premium segment.

Key metrics

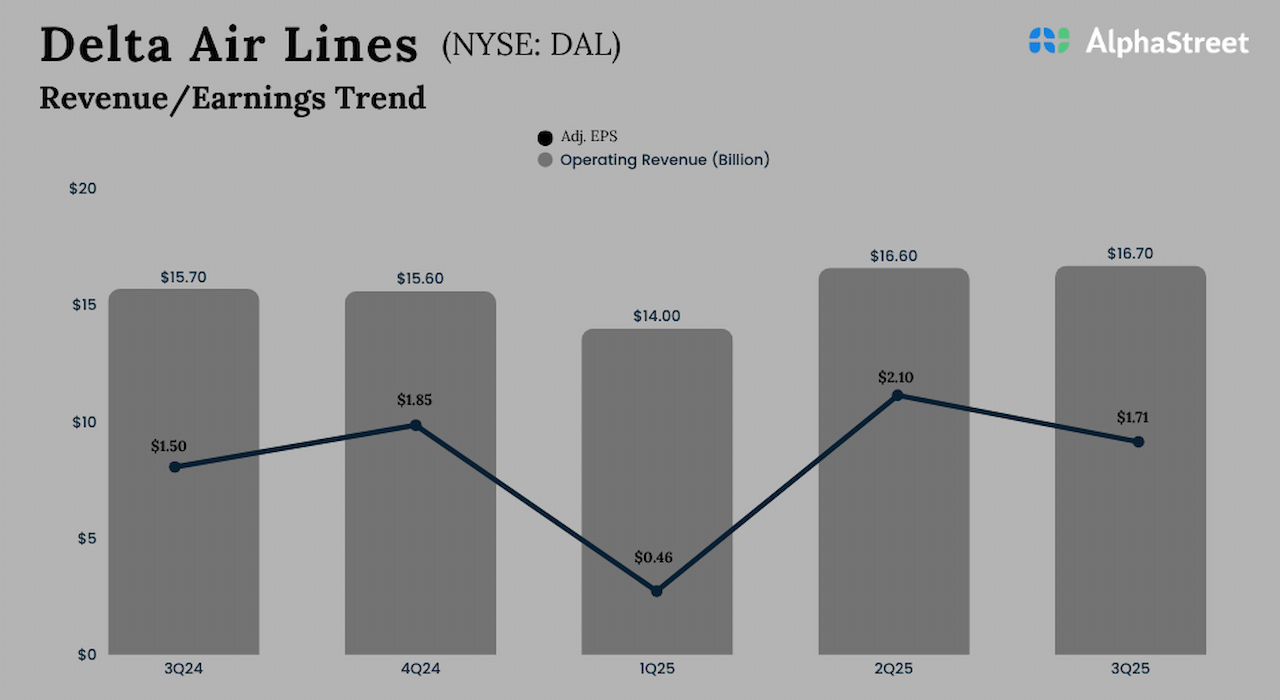

For the third quarter of fiscal 2025, Delta reported operating income of $16.7 billion, up from $15.7 billion in the year-ago quarter. Adjusted earnings per share rose to $1.71 in the September quarter from $1.50 a year ago. Both revenue and the bottom line exceeded Wall Street’s expectations, after outperforming for the next three quarters. On a reported basis, net income was $1.42 billion or $2.17 per share, compared to $1.27 billion or $1.97 per share in Q3 2024.

Delta CEO Edward Herman Bastian said on the Q3 earnings call, “Structural change is taking hold across the industry as unprofitable flights are being adjusted and carriers are not getting their costs changed to prioritize returns. Against this background, we expect to deliver a double-digit operating margin again in the December quarter, with revenue comparable to what we achieved in the September quarter. This will be at or above our all-time high for our full 4-year earnings period of approximately $6.00 per share, which is in the upper half. of our July guidance range.”

Flying High

For fiscal year 2025, Delta’s management is forecasting adjusted earnings of about $6 per share, above analysts’ consensus estimates, and free cash flow between $3.5 billion and $4 billion. It continues to advance its fleet renewal program and aims to deliver 40 aircraft by 2026. The company will benefit from low interest rates when it taps into the capital markets to make growth plans. Also, moving from traditional pricing patterns to an AI-driven dynamic pricing model is expected to increase revenue and strengthen overall yield.

On Tuesday, shares of Delta opened at $69.49 and were down slightly in early trading. Although the stock has gained about 8% in the past 30 days, momentum has been limited in recent sessions.