A $350K Wire Almost Went Into a Scam How a Fraudster Used the US Embassy to Steal $350K

What I think: How a fraudster entered the US embassy in the Middle East with forged documents…and came out with certified closing documents for our Gulf-front FL deal.

We were literally an hour away from wiring $350K for a fancy filling station when the title company pulled the plug on insuring the property.

When the “Perfect” Deal Starts to Show Cracks: The Problem of Sin

Let me paint you a picture:

Even in this tricky market (and our reluctance to fill lots), the deal looked amazing. It’s worth $700K in storage (about $800K), under $350K contract.

The seller was Canadian and had owned the property since he picked it up from the bank for $220K during the 2009 crash (it had previously sold for $1.6M in 2006, and that seller just made a mistake). The matter has been investigated for having financial problems, and I have personally reviewed every line of the seller’s call documentation.

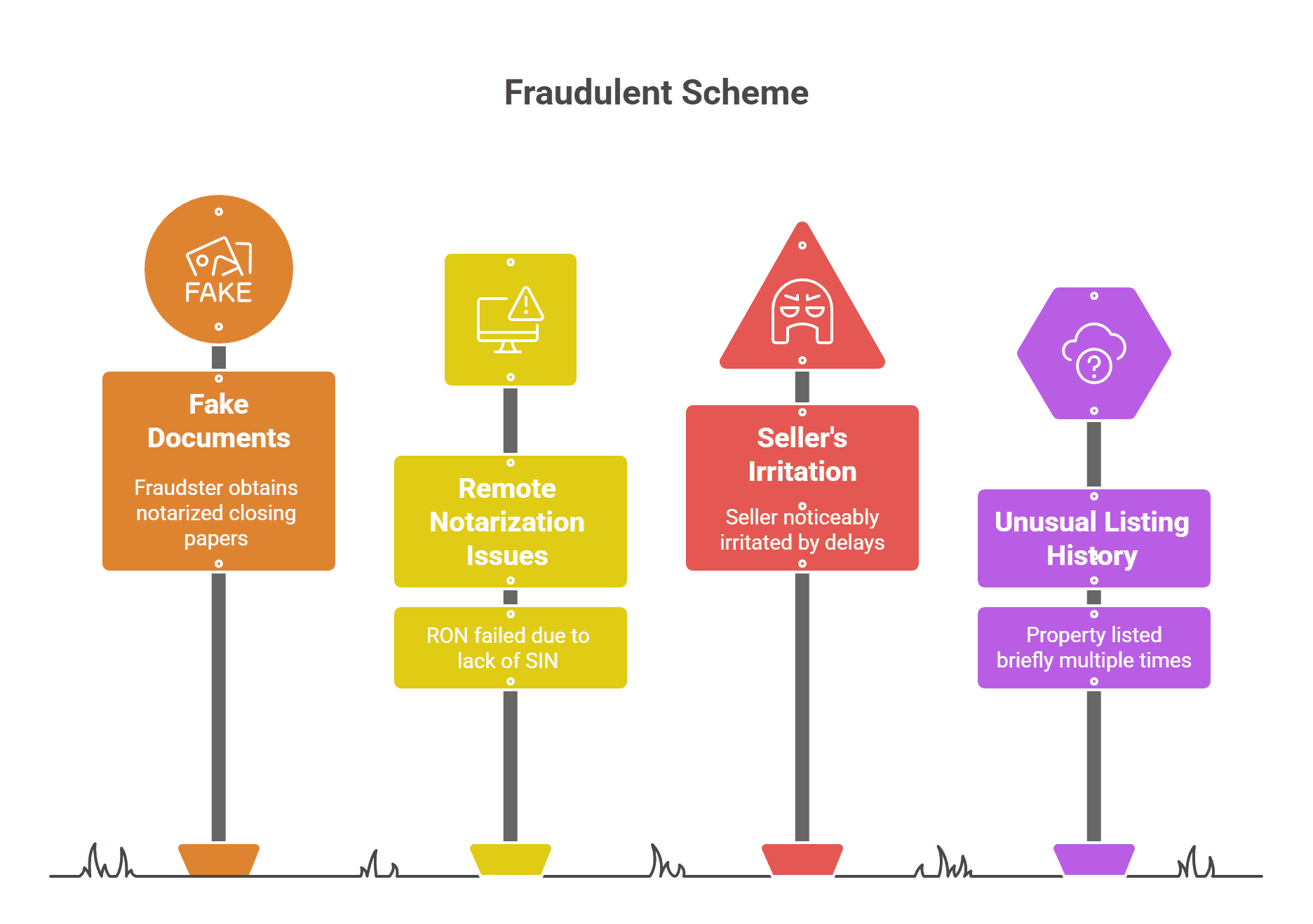

The site was listed twice within the last 3 years (but only for a few days each time. It’s rare, but used to release cannon-driven sellers).

Understanding the Withholding Tax Requirements of FIRPTA

The price we got was solid, but it was “too good to be true,” and there were some fluff in the area, like burrowing owl nests that would need to be addressed, and an old seawall that would need to be replaced at a cost of about $40K. Everything is straightforward.

The seller appears to be working (legally) on oil rigs off the coast of the EU or the Middle East. He wanted to complete the closing using remote notarization online (RON), but that is only allowed in the US and Canada.

We arranged a 2 day window to close, when he would return to Canada, to manage it remotely before flying to Dubai for 2 months.

The closing was scheduled for Friday afternoon, but as (usually) happens, RON’s start time was significantly delayed until 7:30 pm ET, apparently after business hours, and there was no title company support. The salesman was noticeably upset, and I couldn’t blame him.

We followed up the next day, and the RON could not be completed. His ID was verified, but because he didn’t have his SIN (the Canadian equivalent of an SSN), the settlement attorney couldn’t proceed.

This was a red flag, but not a deal killer. The seller sought multiple citizenships, and after further research, the SIN is not issued to every Canadian citizen and serves a tax purpose rather than an ID purpose. That he couldn’t get support on Friday night was also a mitigating factor.

The investor who brought us the deal had a scanned copy of the seller’s passport, which appeared to be legitimate, and they had run it through an anti-fraud check. In addition, this global investor is one of the biggest in the industry, has faced scams in the past, and is still investigating.

There was healthy skepticism, but things kept checking, including a salesman with official canadian cell phone instead of the typical VOIP number of many scammers.

In any case, the time he was in Canada had passed, and we would have to work through the American embassy in Dubai to get the registration done.

The seller confirmed the appointment at the embassy. In the meantime, we have confirmed with the title that we can still close without the seller having a SIN or US TIN (for FIRPTA purposes).

Again, we all consider this odd, but if the seller was trying to get past the tax requirements, that wasn’t our problem.

(We also had a history of closing a FIRPTA foreign merchant agreement in the past with a merchant who did not have a TIN, and there were no consequences from the IRS…and remember, that’s when the government isn’t shut down, half of the workforce is laid off.)

Given that Florida deeds require two witnesses, the seller needed to bring those people to the embassy.

We doubted his ability to submit, but he kept his time and sent back scanned copies of all the documents. Everything seemed legit, the title company gave the go ahead, and we arranged to finance the deal and closed 2 days later when the original arrived via DHL.

Notably, the seller requested that the funds be distributed to three bank accounts in Dubai gradually, but again, this was understandable because we did not know how each financial institution works, especially in foreign countries. And we regularly see restrictions on home wire transfers, especially outgoing ones.

Disbursement of funds occurs on the day of funding.

Similar Pictures No One Saw: How AI Found What Humans Missed

The title company wanted to confirm the wiring instructions as a last step before closing. The merchant has provided a US domestic account on behalf of another person.

The title company noted this and asked the seller for an explanation. The seller said they are a joint account holder with that “relative” and recommended setting up the account to make it easier than paying multiple installments for Dubai accounts.

I called the title co. The VP at that time, requests that since we have come here, we should check the accounts in Dubai, and if it is legal, let us close it, even if they charge additional telephone fees to the merchant in installments.

The title company returned the update, and soon after, posted a PDF notice that said, “We cannot guarantee this purchase. We cannot provide further details.“

Anyway, even though they usually can’t share details about these decisions (liability concerns), I called them and pushed the information, considering how deep it was.

They were cagey, but they said the bank accounts didn’t come out, he said, “We are very sure that this is not a genuine seller. Lots of flags throughout, and we can’t insure this. The dealer’s pocket was also suspect; look at those IDs again.“

I stared at the papers. They look legit. You crossed my limit. Everyone’s limit has been exceeded.

He could not share more details, but: “Pay close attention to IDs.“

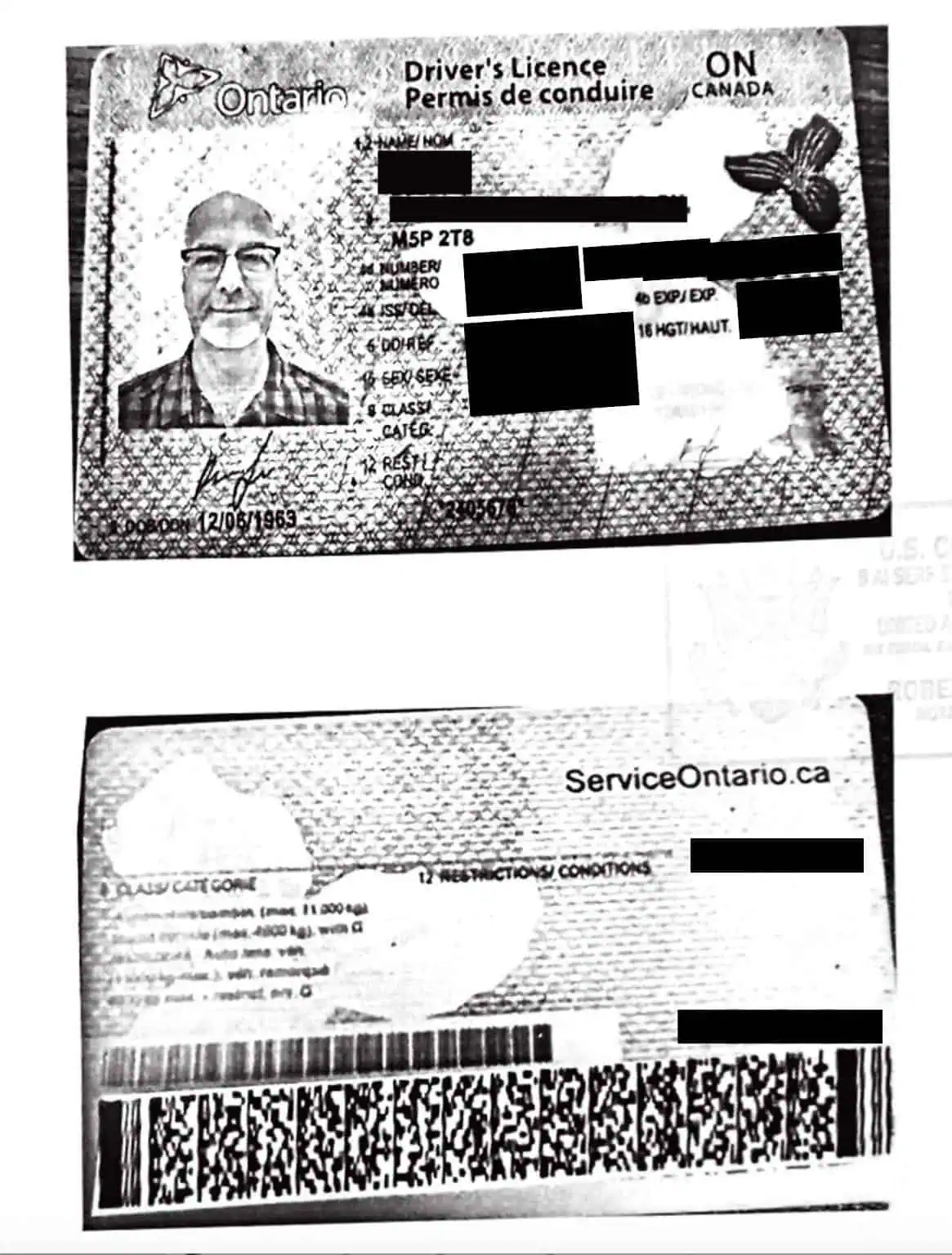

(Here’s the passport and driver’s license – names and addresses redacted. Take 30 seconds. Notice anything that’s off?)

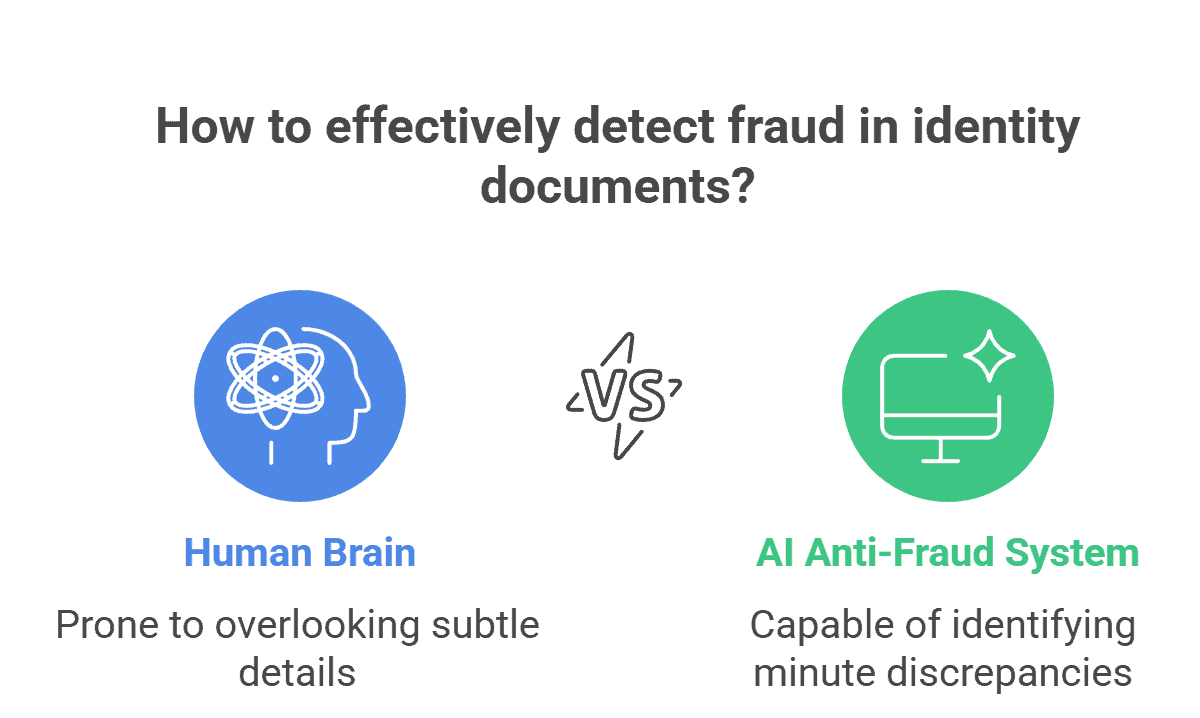

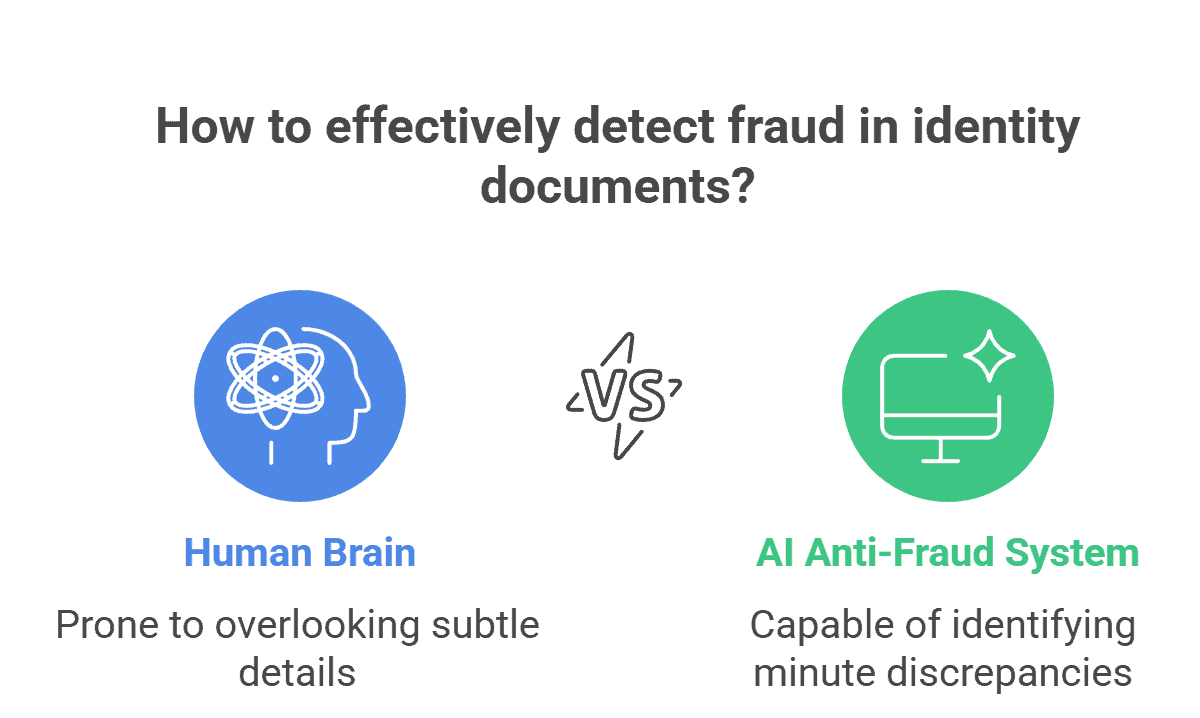

So, I threw them into the instant anti-fraud ChatGPT, and the AI raised the alarm about it ten different stories we were all missed.

The most obvious…

Driver’s license photo and passport photo are available the same.

(If you caught that quickly, kudos to you!)

That doesn’t happen. Always. Different pictures, different angles, different times. But what if you don’t want it specifically? Your mind doesn’t register.

And once you see it, it’s like a slap in the face.

Some red flags caught by AI:

- The original passport was terminated prior to his alleged issuance date

- The signature overlay is off by ~5-7 millimeters

- Most formatting inconsistencies are only visible through forensic-level analysis

How A Fraudster Got Into The US Embassy With Fake IDs – And Succeeded

When the reality of this closeness began to settle in, I had to sit down, frankly out of fear of the level of sophistication of this scam.

Think about it:

He was based in Canada. He targeted a real estate owner in Florida who shared a similar background, and it was almost the equivalent of a ‘motivated seller’.

(Open Question: Previous listing history of the property, was it a fraud, or the real owner?)

You have passed the initial requirements for the RON ID (including the passport scan), except for the SIN… which means you have been able to answer the ID verification as “What is your color? [model/year] car?” or “What address do you live at?“

And most surprisingly, he entered the American embassy in the Middle East (?!) with a fake ID, along with two witnesses (were they there or did they think he was legit?). And he successfully received his documents!

Think of the muscle it takes to pull that off.

If you get caught impersonating someone in the Middle East, I don’t even want to imagine what will happen next.

Sweating bullets, holy cow…

(Makes me wonder if he got through airport security with the same fake documents.)

And he almost walked away with $350K.

Almost.

Fraud Prevention Protocol: AI-Powered ID Verification Before Due Diligence

Now we need merchant IDs in advance and use them sophisticated AI anti-fraud alerts before investing any DD resources.

Here is the custom GPT we created: [Access the Fraud Detection GPT here]

Will that hold everything? No. But he would quickly catch the young man.

Note: Florida is the largest fraud state in the country, and international sellers need extra scrutiny. But even with in-home deals, use AI-powered IDs before you go deep.

(After uncovering another fraudulent sales attempt recently, we skip and track every single salesperson, in addition to reviewing their IDs, so we can determine if there are any red flags associated with their communication methods. The risk of fraud is high for cold calling, text, or PPC leads.)

The title company has finally saved it because it is facing a huge lawsuit. If they were to confirm this, and the original owner files a title claim? We will have to recoup any profit from the sale of the property. They will have to release the entire chain of title and return our down payment to purchase the property.

It’s a nightmare situation that can haunt us for years down the road.

Credit to them for catching it when we were all ready to close.

Actual testing: We dodged a bullet and learned an important lesson.

In the future? We will hold it at the ID verification stage…not on the day of the grant.

=====

Are you looking for funding for workers studying near disasters? Serious Land Capital now applies AI fraud detection to all seller IDs before investing significant DD resources. $50K minimum purchase price. It is very fluid and ready to move at a moment’s notice.

Analyze Your Property Today

Originally published on October 20, 2025