Is Dogecoin Down? 3 Analysts Breaking the Charts

Dogecoin ends the first week of 2026 parked in a set of long-watched foundations, and three analysts focused on the chart converge on the same question: is this high low starting a wider process of laying down, or just another pause within a major correction leg?

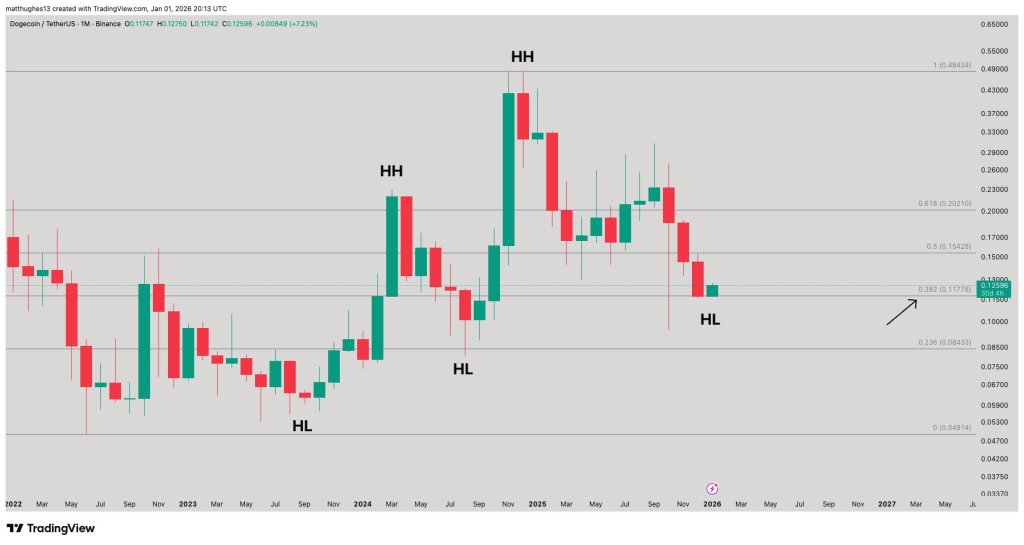

Dogecoin Annual Chart

On a year-to-year basis, the Cantonese Cat chart stands for 2025 as part of the support of 0.786 of the Fibonacci log of approximately $0.10879, where the market prints an internal candle at the end of the year. In that formation, the key to take is not the momentum but the formation: the price is respected by a large line of recovery in the log scale and stayed in the box between the range of the previous year: “DOGE ended in 2025 holding the 0.786 log fib as support, forming an internal candle, likes to continue bullish,” wrote the analyst.

The same annual chart is also in the context of “continuation” in the annual outlook: the next major reference level is the 1.0 fib line rising to $0.73905. That is not presented as an immediate target, but it emphasizes why analysts care about this area, if the 0.786 level holds on to the highs, the upside of the chart map is structurally open, even if the path is not straight.

Related Reading

Monthly DOGE chart

Matt Hughes’ “The Great Mattsby’s” monthly chart reinforces the focus on a single, precise level: the 0.382 Fibonacci retracement at $0.11778. Price is shown holding that line while drawing what the chart labels as a high low, and the analyst explains what that might mean in terms of market structure.

“To me, this looks like the high low needed to start the bearish process, especially with price holding the 0.382 Fib retracement at 0.11778,” Mattsby wrote, adding that he views the “.11-.12 area” as compelling on a risk/reward basis. In this framework, the thesis is conditional: the market is not “bullish” because it crashed, it is constructive because it is trying to stop making lows while protecting against redefinition.

Related Reading

If that $0.11778 level opens the way monthly, the same fib ladder shown on the chart highlights the references below it, including a 0.236 retracement around $0.08433. On the upside, the next visible retracement markers are $0.15428 (0.5) and $0.20210 (0.618), which would be the closest points to “prove it” if this is, in fact, a fundamental process rather than a dead cat jump.

Dogecoin weekly chart

Kevin (Kev_Capital_TA) converts the weekly emphasis. For X, he wrote: “It’s still early but Dogecoin is currently printing a really nice candle that wants to change every week in the most sought after area.”

His conditions are strong and time-bound: “If you can confirm that weekly candle on Sunday evening, and find the 4HR 200 sma/ema in both Doge and BTC then you can see a low entry in this major disciplinary phase and the counter trend going up a lot. All eyes are on 88K-91K on BTC.”

For Dogecoin traders, the immediate calls are straightforward: Dogecoin needs to continue to defend the $0.11–$0.12 area, while the weekly close confirms or negates Kevin’s reversal candlestick view.

If the price loses the monthly retracement of $0.11778, the “low” narrative quickly weakens; if it holds and begins to regain nearby resistance levels, the charts together argue that the market may change from a correction to a fundamental structure, which is guaranteed to close in time.

At press time, DOGE traded at $0.13242.

The featured image was created with DALL.E, a chart from TradingView.com