Chainlink Eyes Breakout After Big Binance Withdrawal Reduces Exchange Supply

Chainlink (LINK) is showing signs of renewed momentum as it nears a key resistance level at $14.50, indicating a possible short-term breakout.

Related Reading: How SWIFT Can End Up Working With XRP For Global Payments

The price of the token has been consolidating within the defined trading channel, with investors watching closely to see if it can surpass this important threshold amid reduced supply from Binance’s massive withdrawal.

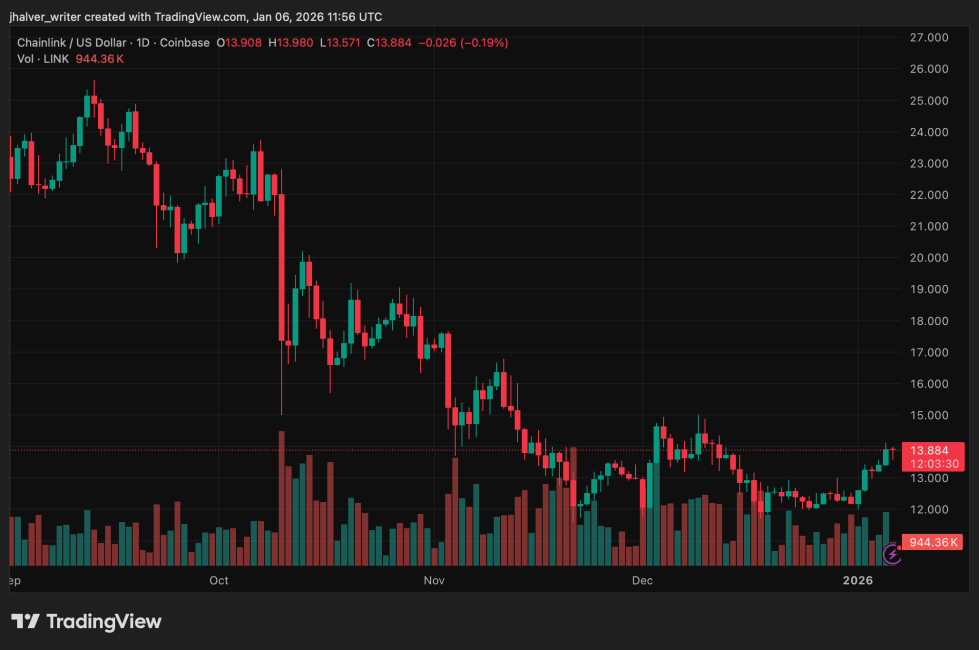

LINK's price trends slightly to the upside on the daily chart. Source: LINKUSD on Tradingview

Chainlink (LINK) Approaches Key Resistance Level

Currently trading around $13.70, Chainlink has steadily gained from a recent support area near $12.60. Technical analysis suggests a strengthening range, price action approaching the upper band of its channel.

The 50-day and 200-day moving averages (EMAs) show an overall uptrend; however, a break above $14.50 is needed to confirm bullish momentum. Indicators such as the MACD are showing early signs of easing bearish pressure, while the RSI is suggesting growing market demand.

The $14.50 resistance is in line with the horizontal resistance identified by analysts, making it a key area for buyers. If LINK is able to break this level and continue above it, the token could test the upper target in the $15 to $16 range. However, failure to hold support near $13.30 could lead to a retest of intraday lows.

Impact of Binance Withdrawal on Supply

The significant withdrawal of Chainlink tokens from Binance has reduced the circulating supply available on the exchange.

These reductions could strengthen the currency and add upward pressure on the token’s value as fewer coins remain accessible to the exchange. A drop in supply in major markets is often associated with price appreciation, especially if demand remains stable or increases.

Chainlink’s role in DeFi and beyond

Chainlink’s oracle network supports many decentralized finance (DeFi) applications by providing a secure, tamper-proof data feed to smart contracts.

This capability continues to drive institutional interest as the platform connects multiple blockchains and real-world data sources, facilitating decentralized, trustless finance. Its technology remains essential to the widespread adoption of decentralized solutions, positioning Chainlink as a key player in the crypto ecosystem.

Related Reading: Bitcoin Rallies on Venezuela’s Oil Issue: Here’s What’s Wrong

Chainlink price action in January 2026 will be influenced by all market trends and investor’s desire for reliable oracle infrastructure. A recent confirmed breach of the $14.50 resistance may indicate a new bullish phase for LINK, supported by January’s better performance trends.

Cover image from ChatGPT, LINKUSD chart from Tradingview

Planning process because bitcoinist focuses on delivering well-researched, accurate, and unbiased content. We maintain strict sourcing standards, and each page is diligently reviewed by our team of senior technical experts and experienced editors. This process ensures the integrity, relevance, and value of our content to our readers.