Bitcoin Price Breaks 6-Week Downtrend—Is This Rally Real?

Bitcoin recently broke out of a six-week bearish price pattern, a technical signal that many traders are watching for trend reversals. BTC traded near $91,300 after long resistance, shaking off weeks of sideways action. The move comes as institutional money continues to flow into ETFs, as global tensions test appetite.

Price action is important because breakouts often reset investor psychology. After weeks of hesitation, buyers finally jumped in with confidence. The question now is simple. Does this move have real fuel, or is it disappearing?

In hindsight, Bitcoin entered 2026 with strong momentum behind it. Spot Bitcoin ETFs and corporate wealth continue to grow, changing how quickly pullbacks are bought.

FIND: Top Ethereum Meme coins to buy in 2026

What does a “Bear Pattern Breakout” Mean for Beginners?

A bear pattern is like a ball rolling down with smaller and smaller hops. Each jump gets weaker. If the price falls above that slope, traders read it as a momentum swing.

This time, Bitcoin escaped a six-week low. That means sellers have lost control. Buyers ended up raising the price. This is important because technical traders often act together. If enough charts flash the same signal, short-term demand increases rapidly.

(Source: BTC Breaks Downward Wedge Going Above $88k / TradingView)

On-chain data adds context. Major owners reversed the recent sell-off and bought about 10,000 BTC after the price cleared $90,000. That buying took some selling pressure from miners and short-term traders.

For everyday investors, this shows confidence from deep-pocketed players. It does not promise immediate benefits. It shows who is willing to buy at these levels.

FIND: Top Ethereum Meme coins to buy in 2026

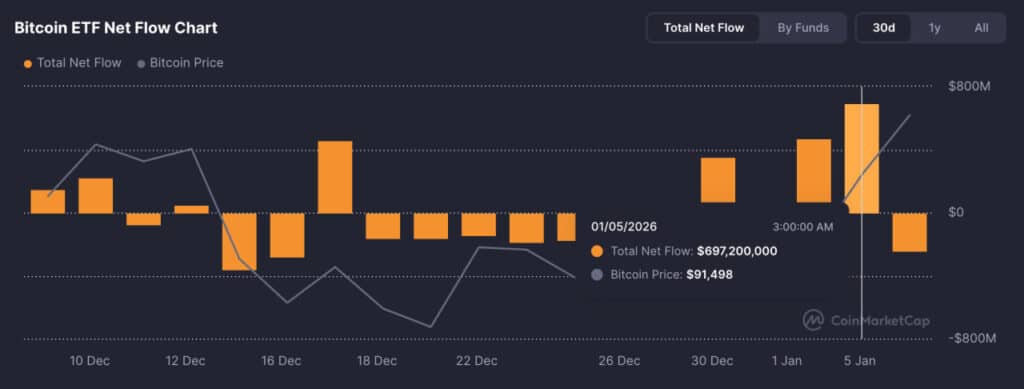

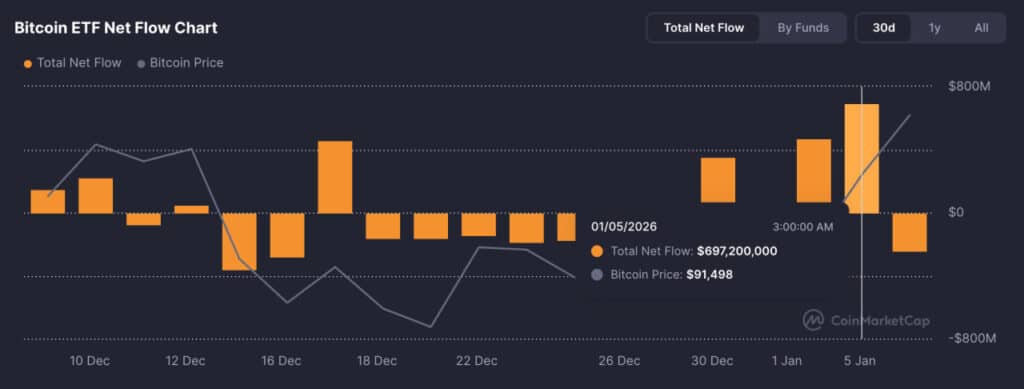

How Are ETFs and Institutions Supporting This Movement?

Spot Bitcoin ETFs act like vacuum cleaners. When investors buy ETF shares, investors must buy real Bitcoin. US crypto ETFs pulled in $5.95 billion during peak inflows in 2025. That demand helped push Bitcoin above $125,000 last year.

That flow is still important now. ETFs reduce the available supply, which makes volatility easier to sustain. Corporate wealth also plays a role. Public companies hold more than 1 million BTC by the end of 2025. These buyers tend to hold back, not convert.

(Source: Bitcoin ETF / CMC data)

This institutional basis explains why dips near $90,000 attract buyers quickly. The need arises before panic spreads.

What Risks Could Stop The Rally?

Miners increased sales as prices rose. Think of miners as gold miners. When prices rise, they sell to cover costs. Miner output exceeded 600 BTC per day. That supply can reduce momentum even during bullish phases.

Technical standards also matter. Bitcoin must hold above $92,000 to target $95,000. Strong resistance remains near $97,000. The biggest shock is still a wildcard. Global markets are still reacting to geopolitical headlines. Risk mitigation measures usually suppress crypto first.

For beginners, the lesson is simple. Breakouts invite excitement. They also invite flexibility when shopping here; size matters. Never chase green candles with money you need for rent or bills.

$BTC has started filling its CME gap now. pic.twitter.com/zGDv8MFP6c

— Ted (@TedPillows) January 7, 2026

The trend of Bitcoin looks much healthier than last month. Confirmation comes from patience, not prediction.

FIND: Top Solana Meme coins to buy in 2026

Follow 99Bitcoins on X for Latest Market Updates and Subscribe to YouTube for Daily Expert Market Analysis

Why you can trust 99Bitcoins

Founded in 2013, 99Bitcoin team members have been crypto experts since the early days of Bitcoin.

90+ hours

Weekly survey

100k+

Monthly students

50+

Professional contributors

2000+

Crypto projects reviewed

Follow 99Bitcoins in your Google news feed

Get the latest updates, trends, and information delivered right to your fingertips. Register now!

Register now