Crypto’s “Best Quarter” Never Seen: Q4 2025 Wiped $1T As Bitcoin Slid And Institutions Split

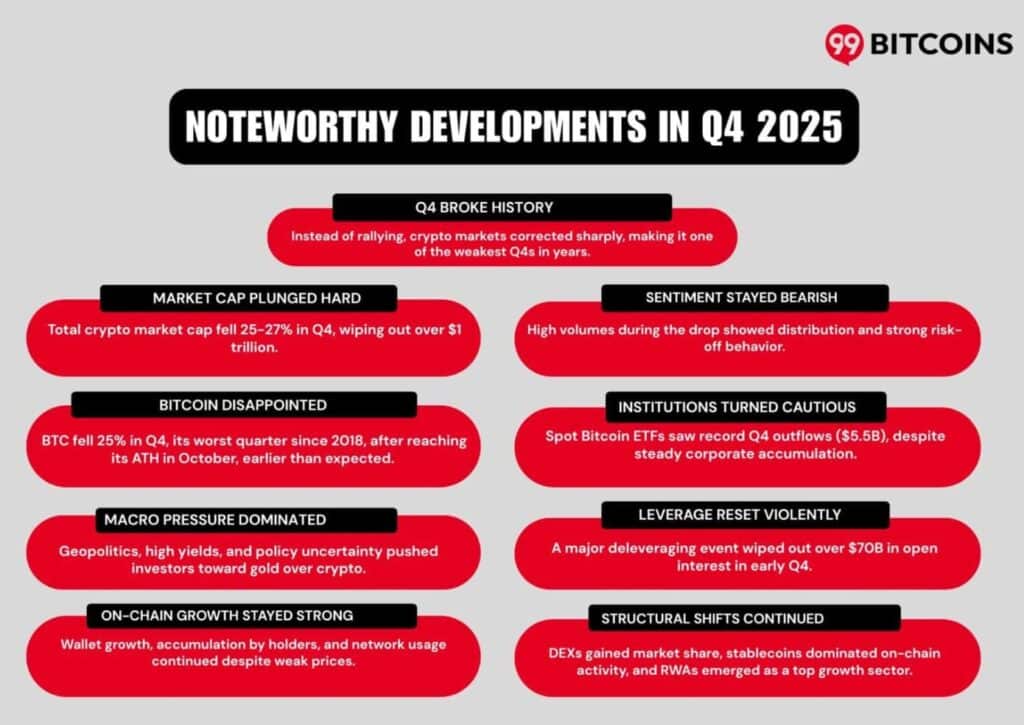

Q4 2025 broke the long season script of crypto. Instead of a year-end rally, the market sold off hard, pulling the total value of the crypto market down to about $2.9 trillion. It pushed Bitcoin from the October high to the low $80,000s. The new 99Bitcoins Q4 2025 State of Crypto Market Report, in partnership with Crypto.com, fit magnifies the move as a risk-taking “spread” quarter – high volume, rising prices, and a cautious stance on all existing ETFs and derivatives.

According to the report, “Investors this quarter were more focused on preserving their money than trying to sell the market.” According to 99Bitcoins, the total crypto market is down 25-27% quarter-on-quarter – one of the highest QoQ drops of the year.

GET: 12+ Hottest Crypto Presales You Can Buy Right Now

So What Really Driven Sales in Q4 2025?

Bitcoin’s correction followed an all-time high in October 2025. It was a quick slide from around $126,000 to the low $80,000 range. However, the report says the declines occurred at higher trading volumes – typically indicating late-cycle distributions rather than gradual declines. Greater sentiment reigned again in late Q4, with price action reacting to US inflation prints and broader risk appetite. All this makes traders defensive.

“Although BTC ETFs had attracted strong institutional inflows earlier in the year, Q4 saw ETF outflows accelerate, and futures open interest remained high as prices fell,” the report said.

“Digital Asset Treasury” companies have increased Bitcoin holdings comprising a large portion of their reported crypto NAV.

Check out: 99Bitcoins’ Q4 2025 State of Crypto Market Report

Shifts under the hood: Stablecoins, DEX Share, Derivatives Leverage

Even though prices are falling, stablecoins have continued to strengthen their role as the backbone of crypto transactions, representing 30% of the on-chain transaction volume and surpassing the current volume of $4trillion by the year 2025, according to the report.

“This increase in stablecoin usage has fueled the growth of crypto-collateralized lending, which reached a peak at the end of Q3 2025, surpassing the previous peak set in Q4 2021,” the report said.

The market share of the building also remained on the move: the trade ratio of the DEX-to-CEX area rose to a low of 20% by the end of 2025.

And what does all this plan for 2026? The report’s basic charge is “not straight forward.” A market that is likely to see strong growth if institutional adoption and regulatory clarity improves.

But for now, any push above $95,000 seems like a giveaway. If it does, the resulting momentum could easily propel the price of BTC USD above the psychological value of $100,000. Considering the positive correlation between BTC and other altcoins, expect some quality tokens to rise in the process. This is what some analysts expect to happen in the next few weeks, if not days.

Check Out: Bitcoin BTC USD Value Eyes $100K on Wall Street Buying

Key Takeaways

Why you can trust 99Bitcoins

Founded in 2013, 99Bitcoin team members have been crypto experts since the early days of Bitcoin.

90+ hours

Weekly survey

100k+

Monthly students

50+

Professional contributors

2000+

Crypto projects reviewed

Follow 99Bitcoins in your Google news feed

Get the latest updates, trends, and information delivered right to your fingertips. Register now!

Register now