Shifting demand and margins in focus as Fastenal (FAST) prepares for Q4 report

The Fastenal Company (NASDAQ: FAST ) is preparing to publish its financial results for the fourth quarter of 2025, after successfully navigating a volatile market environment. The report is expected to shed light on the company’s long-term strategy and how the business is adapting to challenges and opportunities. While the fastener distributor continues to benefit from contract wins from major customers and select price increases in certain categories, demand trends remain strong amid trade-related uncertainty and cautious customer spending.

Measurements

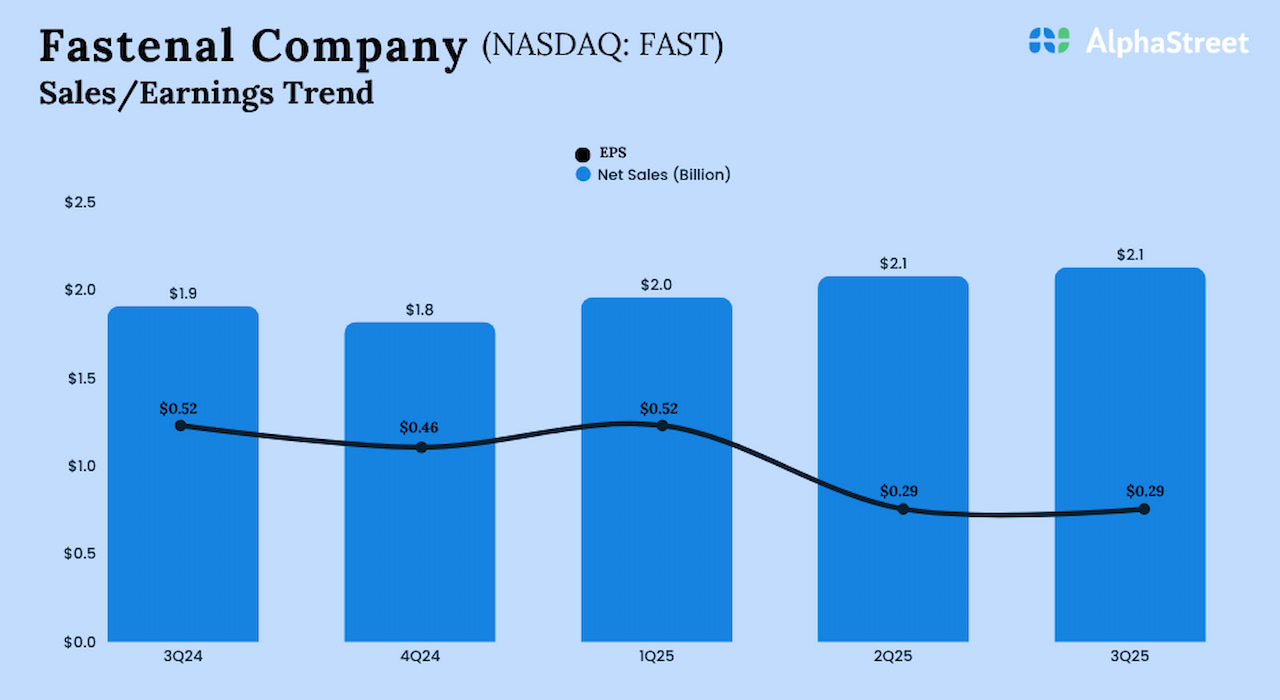

Fastenal’s report for the fourth quarter of 2025 is expected to be published on Tuesday, January 20, at 6:50 am ET. Analysts’ consensus sales and earnings estimates for the quarter are $2.04 billion and $0.26 per share, respectively. In the year-ago quarter, the company earned $0.23 per share on revenue of $1.82 billion.

In 2025, the stock delivered consistent gains and reached its highest value in August. After this crash, the trend reversed, with stocks falling steadily throughout the year. The average price of FAST for the last 12 months is $42.05. Despite recent setbacks, valuations appear high due to the company’s limited growth prospects and continued margin pressure. Fastenal split its stock 2:1 in early 2025, marking the ninth split since going public nearly four decades ago.

Q3 Result

For the third quarter, Fastenal reported net income of $335.5 million, or $0.29 per share, compared to $298.1 million, or $0.26 per share, in the year-ago quarter. Net sales for the third quarter increased 11.7% year-over-year to $2.13 billion, primarily reflecting improved customer contract signings. During the quarter, it signed up 7,050 FASTB and FASTTVend devices, resulting in 19,925 new FASTB and FASTV signings by the end of the first nine months of FY25. The top line was in line with estimates, while revenue missed expectations after beating the previous quarter.

Commenting on Fastenal’s pricing strategy, CEO Daniel Florness said on the Q3 earnings call, “The market is more than the price. We actually prefer not to pass on the price. We prefer to continue to grow. We prefer to have conversations about technology that we can use in your environment. That lowers your consumption. To expand the universe of what we sell, the price conversation is about the increased costs in your supply chain. And the price is how the customer sees that. And so we don’t always see. the needs, and we have open conversations with our customers about what’s going on in their supply chain.“

The Way Forward

Although Fastenal maintains stable sales and cash flow growth, macroeconomic uncertainty and industrial sector weakness remain a challenge. A company’s reliance on a small number of large customers for profit poses a potential risk, especially as businesses face cost pressures from rising costs and changing government trade policies. Management expects that the margin squeeze experienced in the last quarter may carry over into the fourth quarter.

Shares of Fastenal are down more than 2% in the past six months. On Friday, shares opened at $41.79 and gained slightly in early trading.