Crypto Market News Today, January 14: Why Is Crypto Going Up? Bitcoin Explodes at $95K, Ethereum with 7% Price Gain.

Why is crypto going up today? Is it exciting? Bitcoin price jumped higher after US inflation data came in softer than expected, and for a long time, BTC has been looking negative as the bear market became the hot topic. Then it didn’t happen. Buyers stay, sellers retreat. By the time New York opened, the value of Bitcoin had taken off, leaving Wall Street behind.

The price of Ethereum followed with a clean jump of 7% to more than $ 3,300, and suddenly the market woke up, the sentiment turned more bullish, and the fear and greed index began to fear to neutral. What seemed like a routine an hour earlier has turned into full-blown momentum, and the bull run is back!

Crypto Fear and Greed Index

Last updated: Jan 14, 2026

Market Sentiment

Now 36.12 Fear

Yesterday 35.13 Fear

Last week 36.78 Fear

Why Crypto Up? Bitcoin Price Moves Fast

The first real driver behind why crypto is up was positioning. Bitcoin price returning to $94,000 forced us to think twice. Short positions started to loosen as liquidations started to come in, putting pressure on the bears. Nearly 600 million shorts were wiped out in a single day, and the price of Bitcoin was weighed down by the amount of damage.

(source – CoinGlass)

Big data gave the market a boost as core inflation in the US eased slightly in December, while job growth slowed more than forecast. This combination brought talk of a rate cut later and weakened the dollar enough to help breathe in riskier assets. Bitcoin took advantage and its price ran.

As the rally gathers pace, open interest rises, and funding rates move up and down smoothly. None of this was subtle as we rushed back after being on guard for too long.

DISCOVER: 10+ Next Crypto to 100X By 2026

Ground Control to Major Tom, Take Your Protein Pills and Put On Your Helmet

The price of Ethereum is important. It’s the first sign that we’re about to see an altcoin season. ETH rose slightly, supported by renewed inflows into existing ETFs after several quiet periods. Institutional demand returned at the same time Bitcoin’s price broke above, which helped confirm the move when people were going bearish.

On-chain data shows that Ethereum’s price has benefited from lower network fees following recent upgrades, and activity across DeFi has picked up again. Exchange balances continued to decline as owners did not want to sell and became stronger. These signs are often missing from the headlines, but they help explain why crypto feels so stable on the rise this time around.

“You can build on @ethereum L1.”

– @VitalikButerin pic.twitter.com/d1ltwNsN4u

– Token Terminal 📊 (@tokenterminal) January 12, 2026

Momentum Continues to Build

The law sits in the background and has no effect on the feeling. The INDIRECT rule may have been delayed, but ongoing discussions and revised frameworks kept expectations for clear rules. This has reduced the uncertainty, which we need more than the delivery date right now.

After months of hard work, we have a double-sided document ready for Thursday’s tag. I urge my Democratic Alliance colleagues: do not back down from our progress. The Digital Goods Marketplace Transparency Act will provide the transparency needed to preserve innovation in the US and protect consumers. Let’s do this! pic.twitter.com/fuu5CIQa8X

— Senator Cynthia Lummis (@SenLummis) January 13, 2026

Altcoins reacted quickly, outperforming Bitcoin prices as traders pivoted to more risky names. Volumes jumped, sentiment improved, and the market pulled back. The price of Bitcoin held above the support of $94,000, a good level for us, while the price strength of Ethereum continues to support the case of the curiosity of the bull run of this cycle.

Remember, a bull market ends in happiness, not depression.

GET:

Follow 99Bitcoins on X For the latest market updates and subscribe to YouTube For Daily Expert Market Analysis.

JPMorgan Sounds Alarm on Yield Stablecoins and Bank Risk

2025 was defined by crypto stablecoins and high yields. Yes, every investor wishes to return a high return on his investment. Therefore, when the value of stablecoins tracked the greenback shot especially after the approval of the GENIUS Act back in July, it was not surprising that the banks had some kind of objection.

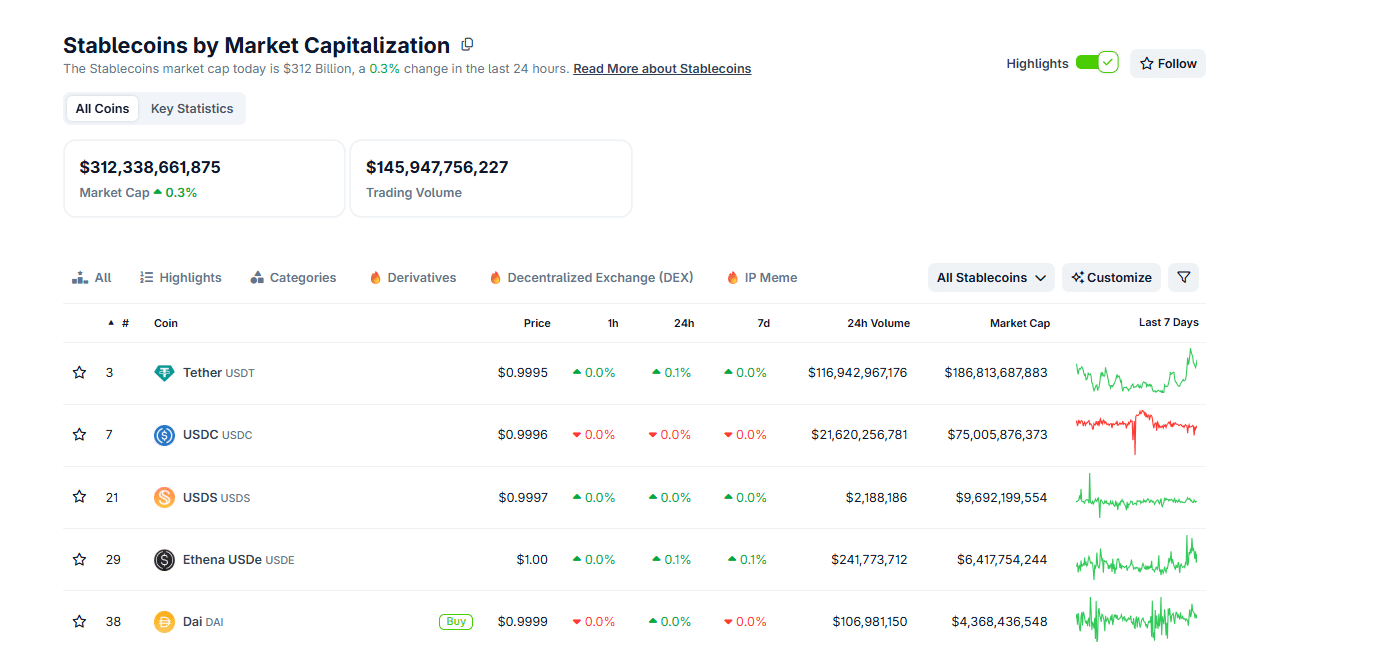

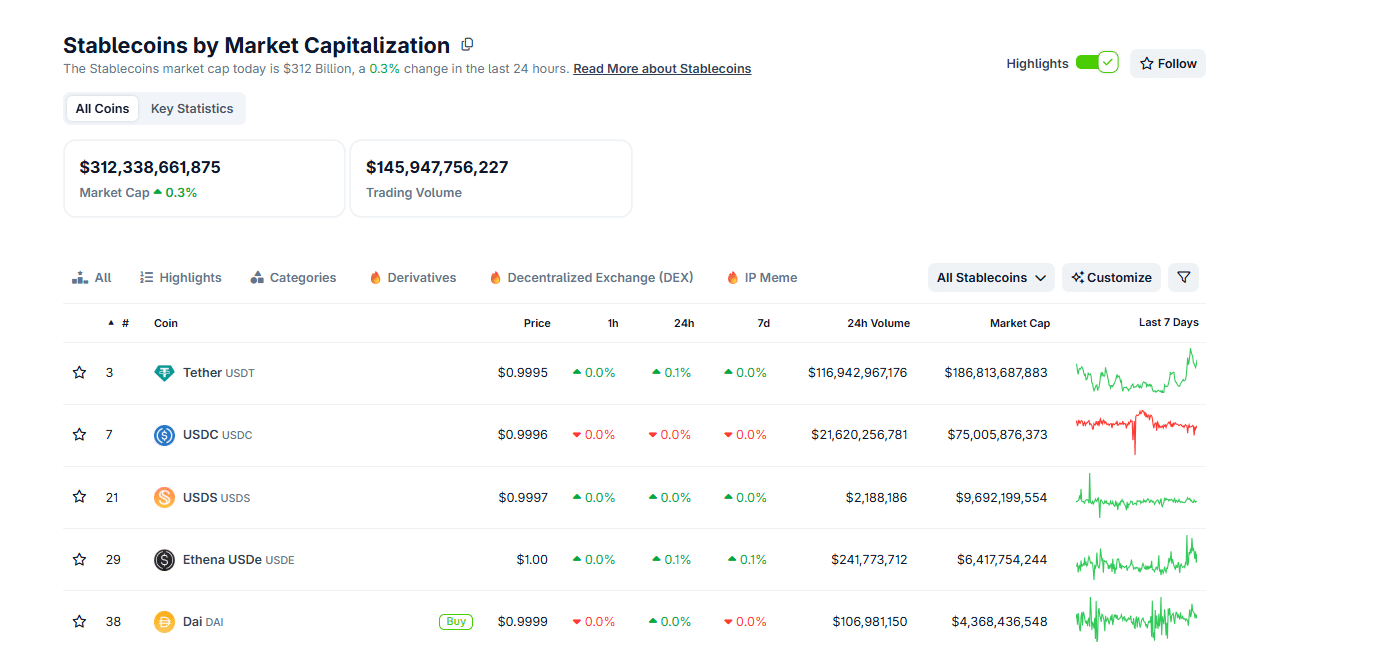

As of January 14th, there are over $312Bn of various stablecoins in circulation. USDT with Tether dominates but there are more from Circle, algorithmic options like USDS.

(Source: Coingecko)

With 2026 likely to be marked by more stablecoins, not everyone is happy. During the Q4 2025 earnings call, JPMorgan CFO Jeremy Barnum warned investors that stablecoins that pay yields risk creating a shadow banking system without long-term safeguards. These comments come as the price of Bitcoin is trading near recent highs, and stablecoin availability continues to increase as new money enters the crypto.

Read the full story here.

ZKsync’s 2026 Plan Aims for Bank-Grade Privacy on Ethereum

Matter Labs CEO Alex Gluchowski shared the year’s project roadmap: What is ZKsync’s plan for 2026?

ZKsync is an Ethereum Layer-2 scaling solution developed by Matter Labs. Make transactions on Ethereum faster and cheaper while maintaining the same level of security. It uses proof of identity, a technology that ensures transactions are correct without showing all information publicly.

This program moves away from early assessment and focuses on building the actual infrastructure that banks, asset managers, and regulated institutions can use. It builds on tools launched in 2025, such as Prividium (a privacy-focused system), ZK Stack (a toolkit for custom chains), and Airbender (a quick proof generator).

The goal is to create systems that meet traditional financial requirements, including strong privacy, full control, clear risk rules, and easy communication with global markets.

Gluchowski described Zksync 2026 as the year to go from initial setup to large-scale implementation, with a partnership aimed at serving tens of millions of users.

Read the full story here.

Why you can trust 99Bitcoins

Founded in 2013, 99Bitcoin team members have been crypto experts since the early days of Bitcoin.

90+ hours

Weekly survey

100k+

Monthly students

50+

Professional contributors

2000+

Crypto projects reviewed

Follow 99Bitcoins in your Google news feed

Get the latest updates, trends, and information delivered right to your fingertips. Register now!

Register now