Uniswap (UNI) Tests Resistance As Traders Eye 30% Breakdown

Uniswap’s UNI is trading below a key breakout line as on-chain activity remains strong and active traders continue to add to positions.

UNI caught close to $5.6 on January 14, the market is retesting the $5.7 region after last week’s pullback.

The token has struggled to bounce back between the $5.50s to $5.60s range, which traders have treated as a temporary ceiling.

This slow move comes after UNI dropped below $5.72 in early January. That level marks the low end of the December range.

GET: The Next 1000X Crypto – Here Are 10+ Crypto Tokens That Can Hit 1000x This Year

UNI Price Prediction: Is Uniswap (UNI) Forming Base After Weeks Down?

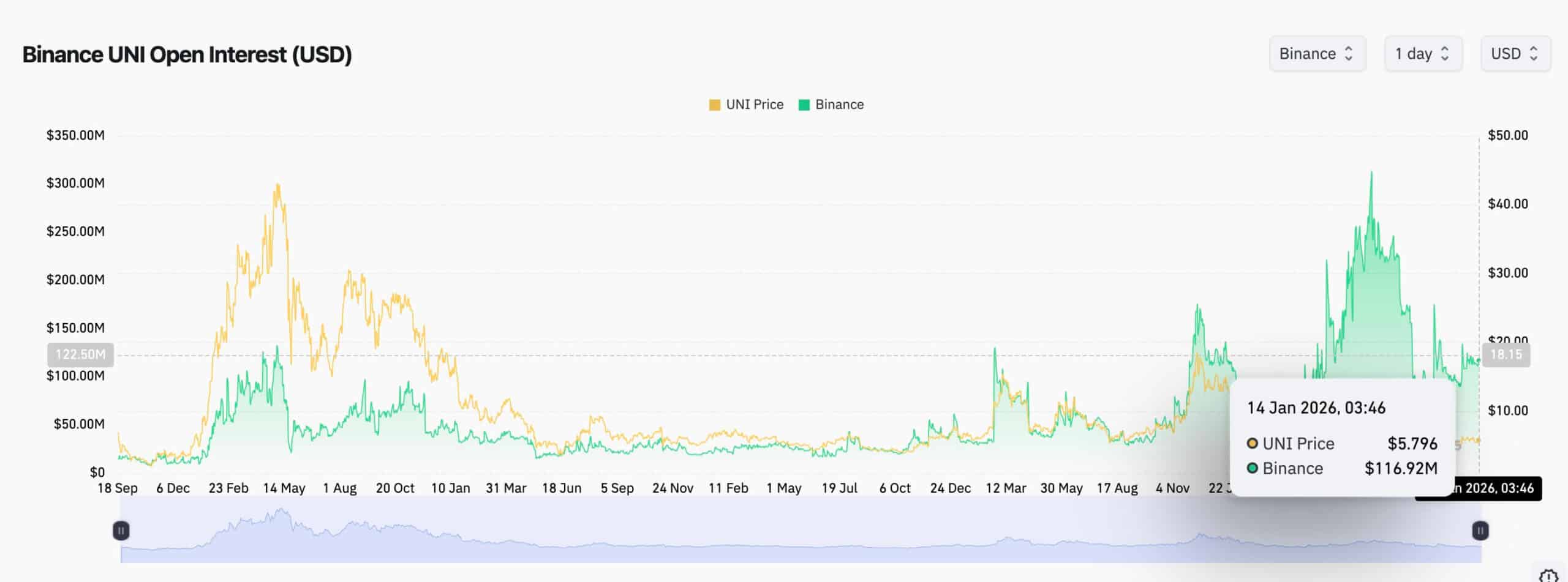

CoinGlass data shows open UNI futures at about $411M, and an estimated $423M in futures trading volume in the past 24 hours.

Traders appear active, as prices struggle to regain lost ground.

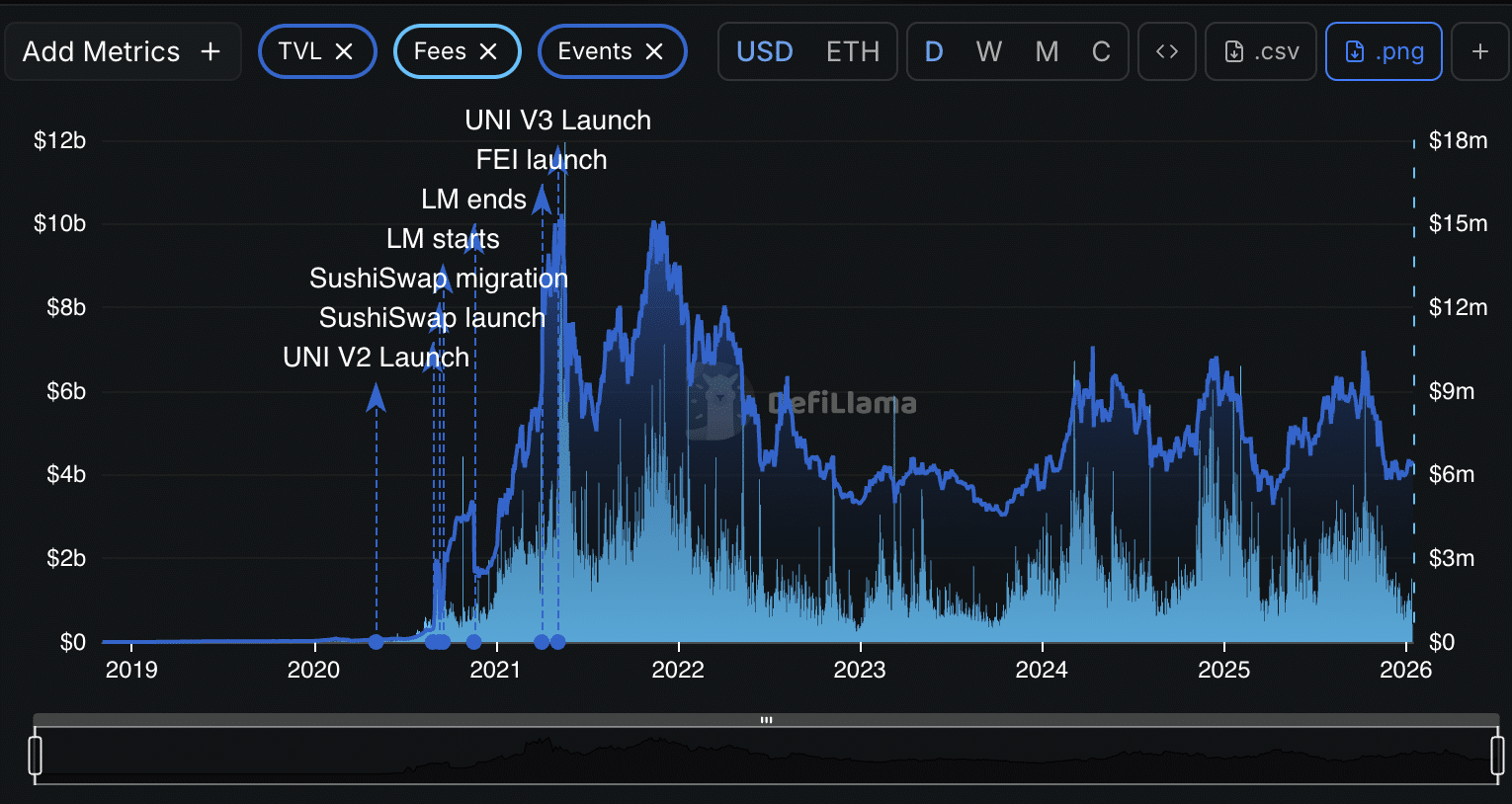

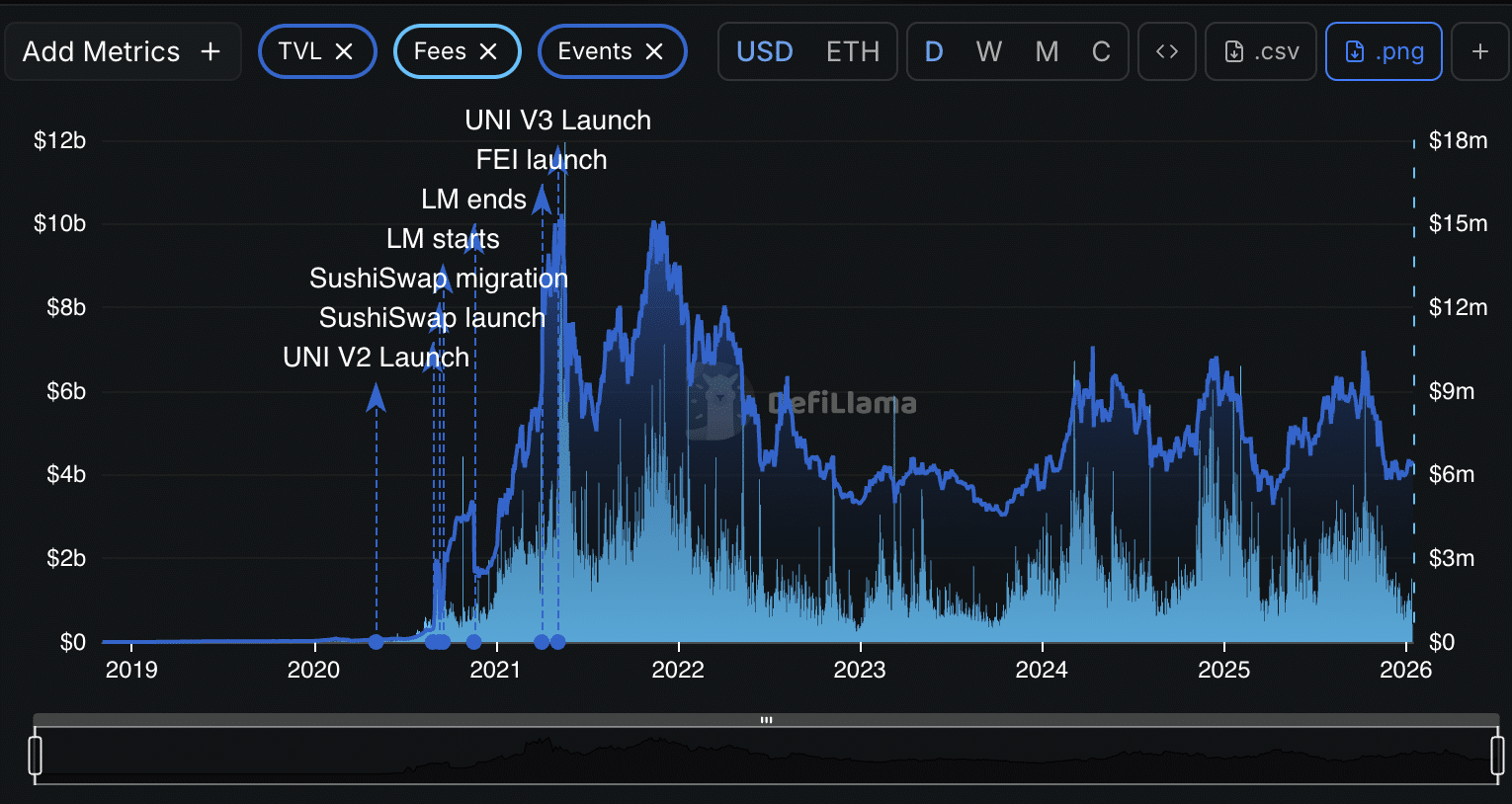

On-chain data shows that Uniswap is still the leader in real estate trading. DefiLlama Houses data shows Uniswap’s DEX volume of about 1.9 billion in the last 24 hours, the highest among major platforms.

Payments are stagnant or the UNI price has moved sideways. DefiLlama data for Uniswap v3 shows about $1.0M in payments in the last day and about $6.1M in the previous week.

The actual gain of the protocol is very low. That gap reflects how much money is going to the money providers, not the protocol itself.

The near-term picture is mixed. In the US, Bitwise has filed for “strategic” ETFs for single assets, including one linked to UNI, based on the SEC. files and previous reports.

Whether those filings turn into approvals or spark new demand is unclear.

GET: 15+ Upcoming Coinbase Lists to Watch in 2026

Is Uniswap (UNI) Stabilizing After Defending $5.50 Support Area?

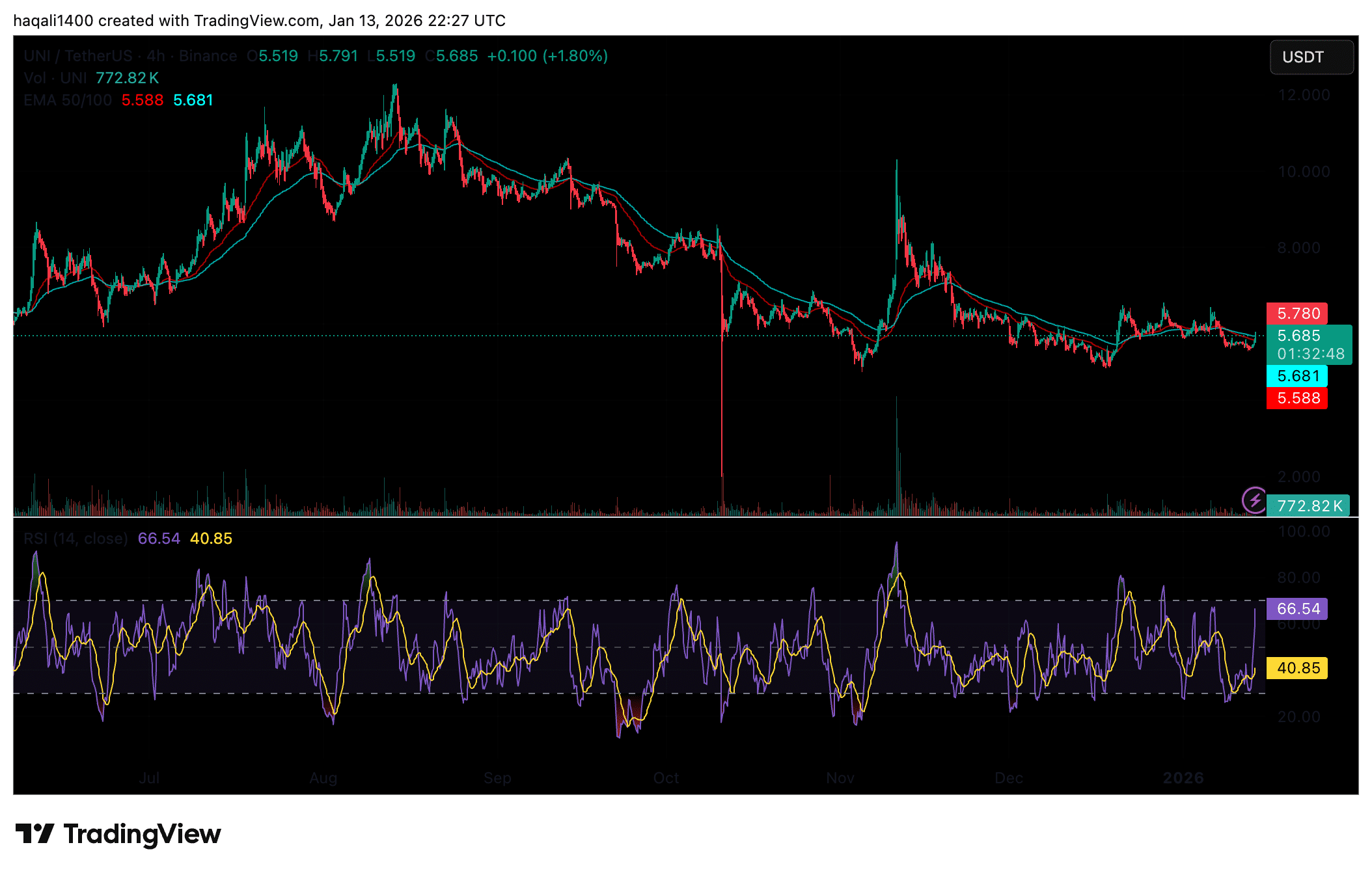

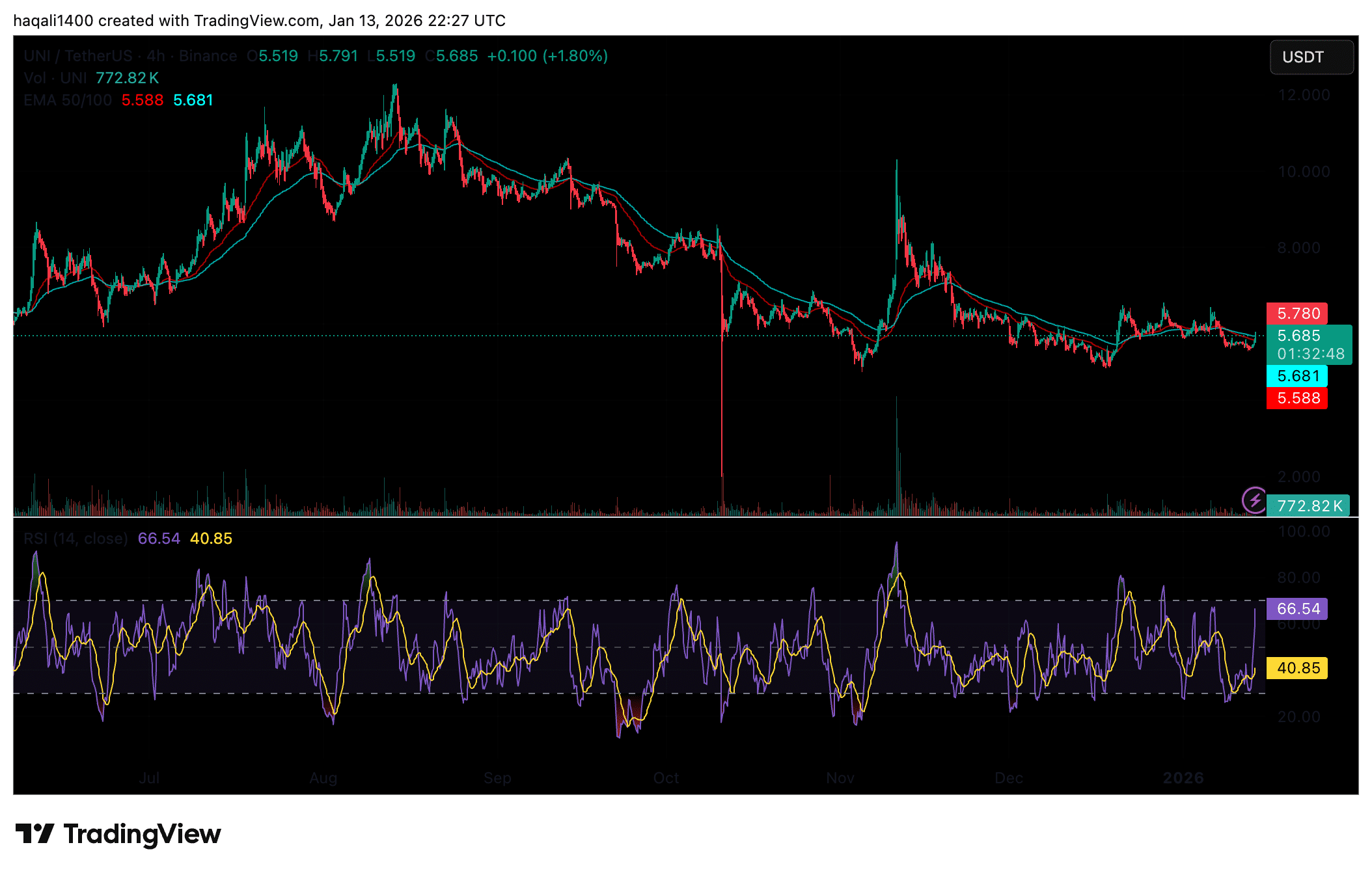

Uniswap (UNI) is starting to stabilize after weeks of weak price action, based on the 4-hour UNI/USDT chart dated Jan. 13.

According to Tradingview data, the Token is trading near $5.68 after holding the $5.50–$5.60 support area several times. That area served as a low in a long period of lower highs that began when UNI dropped from the $9–$10 range in November.

UNI is still in a bad shape. The price remains below the 50-period and 100-period EMAs, both of which continue to decline.

But the distance between the price and these moving averages is decreasing, indicating that sellers are losing momentum. A clear move above $5.80–$6.00 would be the first sign of a short-term reversal.

Pressure symptoms are mixed but improving. The RSI is sitting around 66 after rising from mid-range levels. It is not overbought yet, which leaves room for higher upside if trading volume picks up.

Currently, UNI is stuck in a tight range between the $5.50 support and $5.90 resistance. A breakout on either side is likely to set the tone for the next move.

GET: 10+ Next Crypto to 100X By 2026

Key Takeaways

Why you can trust 99Bitcoins

Founded in 2013, 99Bitcoin team members have been crypto experts since the early days of Bitcoin.

90+ hours

Weekly survey

100k+

Monthly students

50+

Professional contributors

2000+

Crypto projects reviewed

Follow 99Bitcoins in your Google news feed

Get the latest updates, trends, and information delivered right to your fingertips. Register now!

Register now