Ripple Gets Pre-EU License Nod From Luxembourg

Permits. The government nodded. Crypto providers, it seems, cannot escape this. Regulators around the world require blockchain companies, regardless of their offerings, to register and comply with existing regulations. In parallel, officials say that crypto is moving “into the wild”, opening up institutional involvement.

This is good and bad for crypto purists. However, in 2026, if you look at the latest trends, the regulations have their advantages. After years of backlash with the US Securities and Exchange Commission (SEC), Ripple, a blockchain company and a firm closely related to XRP, one of the best cryptos you can buy, is pulling the line. Today, January 14, Ripple said it has received early approval for an Electronic Money Institution (EMI) license in Luxembourg, giving the company regulatory jurisdiction within the EU. The permit was granted by the country’s financial regulator, the Commission de Surveillance du Secteur Financier (CSSF).

Good meeting no @Rippleas they progress towards obtaining their license to operate in Luxembourg.

We discussed their wishes in Europe and Luxembourg, and I confirmed our commitment to digital innovation. pic.twitter.com/JLbEezTGPE— Gilles Roth (@RothGilles) October 9, 2025

Like many tokens, including some of the best cryptos to buy, the XRP crypto peaked before settling down today. XRP price is stable above $2, and is technically bullish, looking at price action from a downside perspective.

FIND: Top Solana Meme coins to buy in 2026

How Did Ripple Actually Get European Approval?

The fact that the price of XRP is strong means that traders are focused on the progress of control, not manipulation. Looking at these developments from Ripple’s position, it’s clear that they’re moving fast, expanding as Europe pushes MiCA rules that reward firms willing to play by clear, strict rules. MiCA is the first comprehensive legal framework for crypto-assets in the EU. There are four rules MiCA makes mandatory for crypto firms. One of them demands that crypto service providers like Ripple must register.

Approval is not final yet. But it shows that European regulators see Ripple as a serious, compliant payments company, not legal gambling. As far as we know, Luxembourg’s financial inspectorate has given Ripple the nod for an Electronic Money Institution (EMI) license. Think of EMI as a digital banking passport. It allows the company to transfer money, withdraw money, and use payment methods under supervision. For everyday users, this is important because EMI licenses open legal access throughout the EU. Once completed, Ripple can “passport” services to other countries without having to reapply each time. To date, Ripple is already registered in Ireland as a Virtual Heritage Service Provider (VASP).

BREAKING: Ripple added to Bank Of Ireland’s list of Virtual Asset service providers 🚀🚀🚀 $XRP

What will this do?

The registration will allow the blockchain and crypto solutions company to provide certain digital asset services within Ireland! pic.twitter.com/SBk0E47VfQ

– MASON VERSLUIS (@MasonVersluis) December 20, 2023

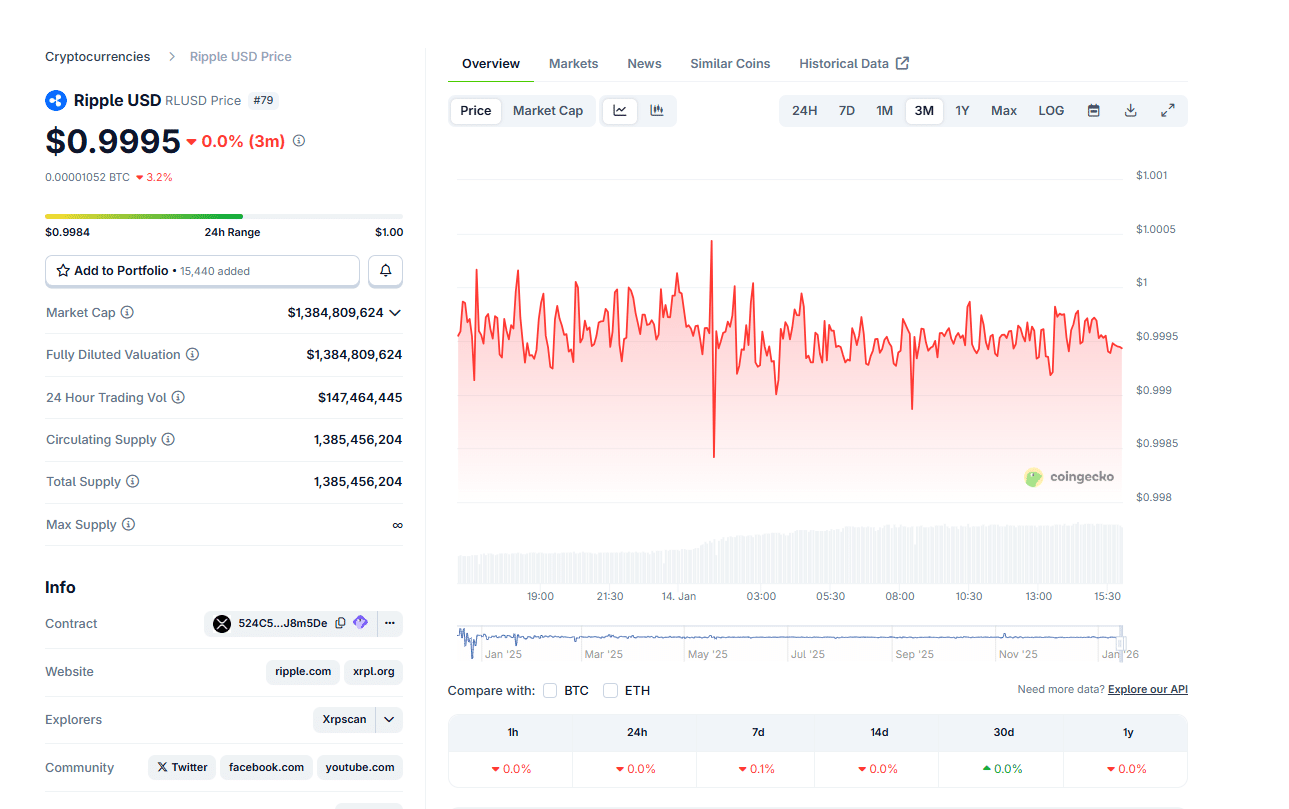

Ripple has prepared for this since 2025 by setting up Ripple Payments Europe in Luxembourg. The country already owns major crypto firms because its regulator acts as a central MiCA authority. Besides opening legal access across the EU, CSSF will allow Ripple to offer regulated payment services including stablecoins and other digital assets. Ripple has already joined the stablecoin fray with RLUSD. Currently, RLUSD is among the top 20 stablecoins with a market capitalization of over $1.3Bn.

(Source: Coingecko)

FIND: Top Solana Meme coins to buy in 2026

Why Europe Matters Now

The US may be a hotbed of crypto innovation and activity, especially after Donald Trump took office, but the EU now offers something special. With MiCA, Europe clearly tells crypto companies how to operate, what licenses they need, and how stablecoins should behave.

This could explain why Ripple is acting so quickly. CSSF’s approval comes days after receiving UK regulatory approval, creating Europe’s first playbook. The more licenses Ripple acquires in different countries, the less legal uncertainty there is. In turn, this strategy helps Ripple sell its payment tools to banks and fintechs. For XRP owners, legality equals practicality. The token that banks cannot touch has a limited value. A wired token in a controlled payment flow becomes more important.

The future of regulated payments for digital goods in the UK is here! 🇬🇧

Ripple has officially received approval for both EMI license and Cryptoasset registration from UK’s FCA.

Who better to explain what it means than the UK and Europe Managing Director @CraddockCJ.… pic.twitter.com/q2xyeJQXEF

– Ripple (@Ripple) January 9, 2026

Apparently, Ripple is planning to expand its services in Europe. RLUSD will be in the middle, and as RLUSD gets more adoption, more demand for XRP, traders will be watching closely to see if Ripple succeeds in Europe. Under EMI’s license in Luxembourg, Ripple can legally connect stablecoins to real payment systems. That opens doors for merchants, payment processors, and settlement partners across borders.

Ripple is also pursuing full MiCA approval next. If it starts operating as a fully regulated crypto asset service provider (CASP) in Europe, they will have the opportunity to offer additional services. As Ripple’s history shows, control wins price support in the long term.

GET:

Follow 99Bitcoins on X For the latest market updates and subscribe to YouTube For Daily Expert Market Analysis.

Why you can trust 99Bitcoins

Founded in 2013, 99Bitcoin team members have been crypto experts since the early days of Bitcoin.

90+ hours

Weekly survey

100k+

Monthly students

50+

Professional contributors

2000+

Crypto projects reviewed

Follow 99Bitcoins in your Google news feed

Get the latest updates, trends, and information delivered right to your fingertips. Register now!

Register now