I don’t care if the stock market crashes. I’m still buying cheap UK stocks

Image source: Getty Images

On both sides of the Atlantic, there have been many warnings of a stock market correction or, worse, a complete crash. Concern that we are in the middle of an artificial intelligence bubble is driving this fear.

But despite these worrying predictions, I continue to buy UK shares. Here are a couple I recently bought.

Hello!

Not to be confused with the US company, Coca-Cola HBC (LSE:CCH) has exclusive rights to distribute the group’s American beverages in 28 countries in Europe and Africa.

Analysts expect strong earnings growth over the next five years as emerging markets will contribute significantly. If these predictions prove correct, based on the current (19 January) share price of £39.16 (€45.16), it means a forward price ratio (2029) of 11.8. This can be incredibly cheap in the field, i FTSE 100and – based on history – in the stock itself.

| A year | Earnings per share forecast (€) | Change (%) | Forward the price-to-earnings ratio |

|---|---|---|---|

| 2024 | 2.28 (original) | +9.5 | 19.8 |

| 2025 | 2.63 | +15,4 | 17.2 |

| 2026 | 2.86 | +8.8 | 15.8 |

| 2027 | 3.14 | +9.8 | 14.4 |

| 2028 | 3.48 | +10,8 | 13.0 |

| 2029 | 3.82 | +9.8 | 11.8 |

It is also forecast to raise 69% of its dividend, which will increase the stock’s yield to 3.9%.

These forecasts were compiled before the group announced its intention to buy 75% of Coca-Cola Beverages Africa for $2.6bn. This will give the group access to 14 other countries with an estimated 40% of sales on the continent.

Although it’s still a very competitive industry and there are fears that weight loss drugs could affect demand, I like the group’s goal of drinking around the clock. And it’s more than that Coca-Cola. These impressive predictions aside, this is why I decided to add the stock to my portfolio and why others might consider doing the same.

A big reboot

After suffering a difficult time due to falling sales, distribution problems, and US taxes, i Dr. Martens (LSE:DOCS) share price has been lagging since its IPO.

Admittedly, the stock is not cheap based on its current financial performance. But if it can achieve forecast March 2028 (FY28) earnings per share of 6.1p, that’s a different story. So the investment case depends on whether this is achieved. I think so.

Challenges remain. There are many cheaper alternatives out there. And it’s hard to stay relevant in the fashion industry.

However, the group’s transformational strategy of selling directly to customers and entering into partnerships in new markets, is showing signs of working. Its FY26 half-year results revealed a 33% increase in footwear volumes compared to last year.

I think the brand retains its iconic status. And despite its woes, it has been reducing its debt and stock levels. More will be known when the team releases its next trading update on January 27. But I think it is for long-term, patient investors to consider.

There are many to choose from

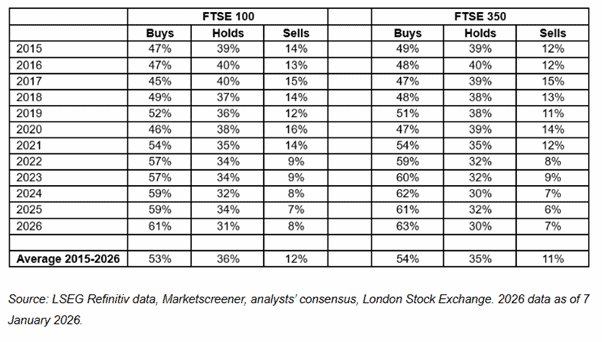

In my opinion, these are just two of the most interesting UK stocks. And as the table below shows, analysts seem optimistic about the prospects for most stocks in the FTSE 100 and FTSE 350with purchase recommendations of 61% and 63%, respectively.

I believe the stock market will crash or, at the very least, undergo a correction soon.

I’m not the one who’s depressed. It is an idea based on the fact that there has been a lot in history. But the important thing is not to panic and keep looking for those conversations. Taking a long-term view is important when looking to build wealth.