Bitcoin Shows Signs of Strength As Analysts Become More Optimistic

Bitcoin has shown the first signs of calm, but the mood is fragile. Prices have pulled back from huge weekend highs and trading has been heavy as investors weigh the headlines of new tariffs and slowing growth in parts of Asia.

Related Reading

Spot Market Signals Made Easy

According to Glassnode, trading volume in the area grew modestly while the net buy–sell imbalance extended above its normal high band. That change points to less pressure on the sell side, even if demand remains stagnant.

Reports note that the markets are gradually growing after taking profits towards the end of 2025, with long-term holders less willing to sell all the rounds. The result is a consolidating market instead of collapsing.

Derivatives Stress And A Sharp Retest

Over the weekend Bitcoin fell 3.2% from its highs, leading to a retest of the $92,000 level which surprised some bulls. That move wiped out about $215 million in profitable futures, a big blow that raised alarms about deeper losses.

Source: Glassnode

At the same time, weak activity in derivatives markets has marked the cooling of appetite, making it difficult for Bitcoin to act as a reliable hedge at present.

Nasdaq futures fell after US President Donald Trump announced new tax proposals aimed at several European countries, and such major shocks often take traders out of risk zones.

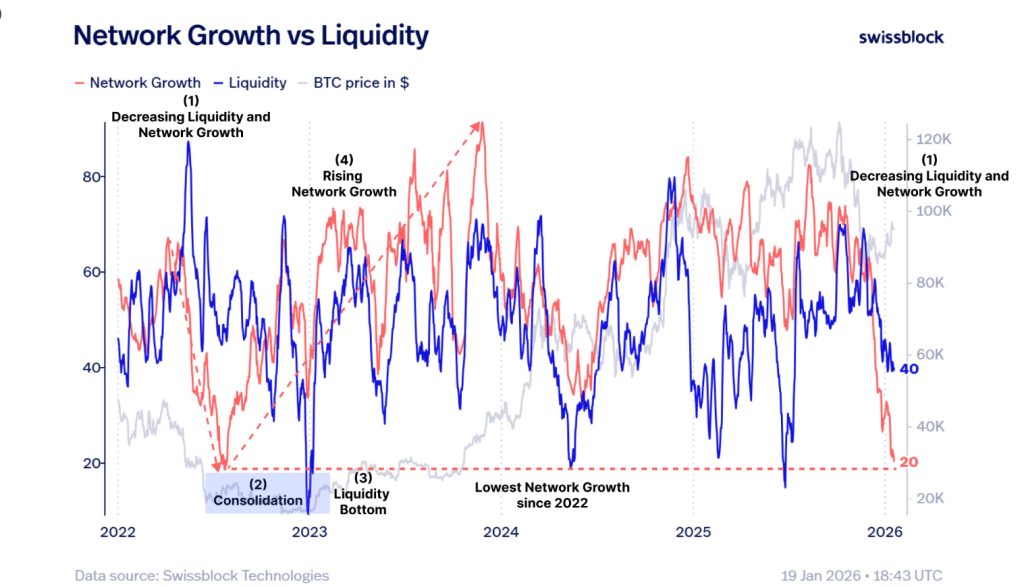

Liquidity Patterns Echo Past Cycles

Swissblock analysts pointed to a slowdown in network growth and liquidity that looks similar to the conditions seen in 2022. Back then, low fiscal deficits and a slowdown in growth led to a long rally, only for both indicators to grow later and drive the price higher.

Based on reports, the current setup could be a precursor to a similar restructuring if network activity recovers and buying momentum strengthens.

Network growth is at its lowest point since 2022, and the economy continues to shrink. Back in 2022, the same network standards started a $BTC the consolidation phase as network growth begins to stabilize, even if the currency remains weak and declining.

History shows that… pic.twitter.com/24sC3aoyAD

– Swissblock (@swissblock__) January 19, 2026

Institutional Flows and Hedge Issues

Analysts say the ETF flows show that institutions are buying on a pullback and that long-term holders are not in a rush to sell.

Gold rose past $4,650, and that safe move, along with soft growth data from China, is dissuading some investors from treating Bitcoin as a portfolio hedge rather than a quick trade.

Alert Outlook

Overall, the signs point to a slow rebuilding rather than a new explosion. Buy-side dynamics have developed, but are not yet strong or broad enough to call a new uptrend. Volatility remains a factor, and country or policy shocks may widen price swings.

Related Reading

For now, the market is not changing while you remain vigilant – more financial stability and clear institutional confidence will be needed to turn this consolidation into a sustainable development.

Featured image from Gemini, chart from TradingView