Metaplanet Plans $137M Bitcoin Buy Using Overseas Stock Deal

Before MicroStrategy started buying Bitcoin in November 2020, it was not unknown for a public company to collect “risky” cryptos. In fact, some of the best cryptos to buy have more than 100X since their inception. However, the lack of clear rules was a major obstacle.

This quickly changed after Michael Saylor went all in on Bitcoin, buying billions of BTC. In January 2026, Strategy sold shares and bought over $3Bn of Bitcoin. Not to be left behind, Metaplanet is also making its own plan to raise money and buy Bitcoin.

新新割当よる新媚定共第25回新株电影権のアフィックションションション pic.twitter.com/YPhua9p7d3

– Metaplanet Inc. (@metaplanet) January 29, 2026

All this happens just when the price of Bitcoin is stuck below $ 90,000, with a fading hope that the price of BTC USD will break $ 100,000 in the next two weeks. Sentiment remains strong, but if you look at the fundamentals, there may be an opportunity for buyers to show their hand.

Crypto Chart of Fear and Greed

1 year

1 m

1 w

24h

DISCOVER: The Best New Cryptocurrencies to Invest in 2026

Metaplanet Plans to Buy $137M in Bitcoin

Earlier today, Japan-listed Metaplanet approved a plan to raise $137M from overseas investors to buy more Bitcoin and pay down debt. Interestingly, even after the news was made public, Metaplanet’s stock did not move after the filing, which is a sign that the markets are already expecting a brutal Bitcoin rally from the company. If anything, it shows that the market supports Metaplanet’s transition from a hotel operator to a “Bitcoin Treasury Company.”

Metaplanet will sell new shares and warrants to foreign investors. In particular, the raising is divided into two main parts to increase capital while controlling the dilution of current shareholders. They are issuing 24.5 million new common shares at about $3 per share, aiming to raise about $78 million immediately.

Metaplanet closed its initial institutional shares + transaction warrants to accelerate our Bitcoin strategy. Total proceeds up to ¥21B, including ¥12.2B from shares issued at a 5% premium (¥499) and up to ¥8.8B from 1-year warrants issued at a 15% premium (¥547 work… pic.twitter.com/OprgedN4Fd

– Simon Gerovich (@gerovich) January 29, 2026

Shareholders also approved the issuance of 159,440 warrants, which give investors the right to purchase additional shares later at a fixed price. If it’s all done within the next year, it could bring in another $56M.

It should be noted that Metaplanet has been very transparent about its Bitcoin trading system. At $137M, a large portion will be allocated to buy Bitcoin. If they do so, it will strengthen their position as one of the largest corporate owners in the world.

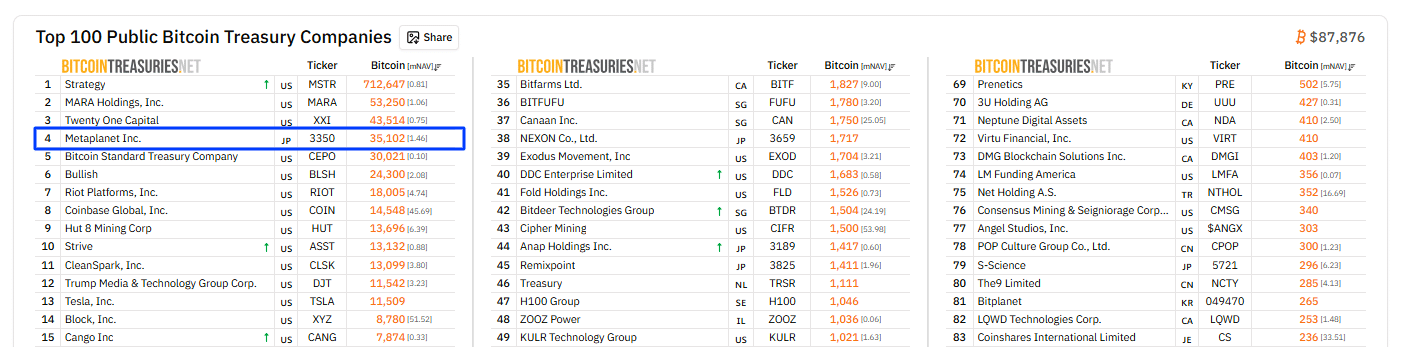

(Source: Bitcoin Treasuries)

Another part of the raised amount will be used to pay off existing loans. Logically, debt cancellation allows them to reload their credit facilities. In turn, this will give them more flexibility to borrow again if the price of Bitcoin falls.

However, unlike MicroStrategy, Metaplanet will be putting its BTC to work. For example, they invest in their share of “Bitcoin income”. This category uses derivatives, such as selling put options, to generate a yield on existing assets.

DISCOVER: The best Meme Coin ICOs to invest in 2026

Is This The New Playbook For Bitcoin Business Finance

Metaplanet calls itself “The Bitcoin Treasury Company.” That means Bitcoin sits at the center of its strategy, not as a side-scroll. This illustrates the playbook used by MicroStrategy and is discussed in our guide to corporate crypto wealth. However, they are a game changer when it comes to fundraising.

The company already holds tens of thousands of BTC worth billions of dollars. By targeting foreign investors primarily through private placements, Metaplanet taps into a deeper pool of capital than is typically found among smaller firms on the Tokyo Stock Exchange. That flexibility is important if you want to buy Bitcoin during a price drop.

The motivation is simple: Metaplanet takes advantage of the high volatility of its stock. Because the stock often trades at a “premium” to the actual value of the Bitcoin held by the company, they can sell expensive shares to buy “cheap” Bitcoin. This is a game straight out of the MicroStrategy playbook.

In addition, diversification away from the Yen means that MetaPlanet is now, more than ever, focused on BTC Yield, which is simply the average amount of BTC held per share. Even if the shares will be diluted after raising $137M, the BTC Yield will increase as they will own more BTC.

METAPLANET MOON MATH

Metaplanet had a 568.2% BTC Yield last year.

Their small size helped.

Even assuming they never trade at a high rate, and assuming a very low BTC Yield, returns are still ridiculous for the next 5 years.

1× mNAV returns 75 % BTC… pic.twitter.com/92zLtbA9rz

– Adam Livingston (@AdamBLiv) January 5, 2026

Overall, this is a bullish sign for Bitcoin. When public firms raise real money to buy Bitcoin, it reinforces the idea that institutions view BTC as a long-term hedge, not a quick turnaround. Corporate purchases tighten supply. Bitcoin has a fixed cap, so when companies lock it on the balance sheet, fewer coins trade freely. That supply pressure tends to support higher prices over time.

GET:

- 16+ New Upcoming Binance Lists in 2026

- 99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the latest market updates and subscribe to YouTube For Daily Expert Market Analysis.

The post Metaplanet Plans $137M Bitcoin Buy Using Overseas Stock Deal appeared first on 99Bitcoins.