XRP Must Hold This Level To Avoid Shifting Into A Macro Bear Structure

The price of XRP has caught up recently a selloff of the entire crypto marketit dropped to an intraday low of $1.57 over the past 24 hours. The sudden drop brings into focus XRP’s higher-term structure, which is teasing a break below the 33-month moving average.

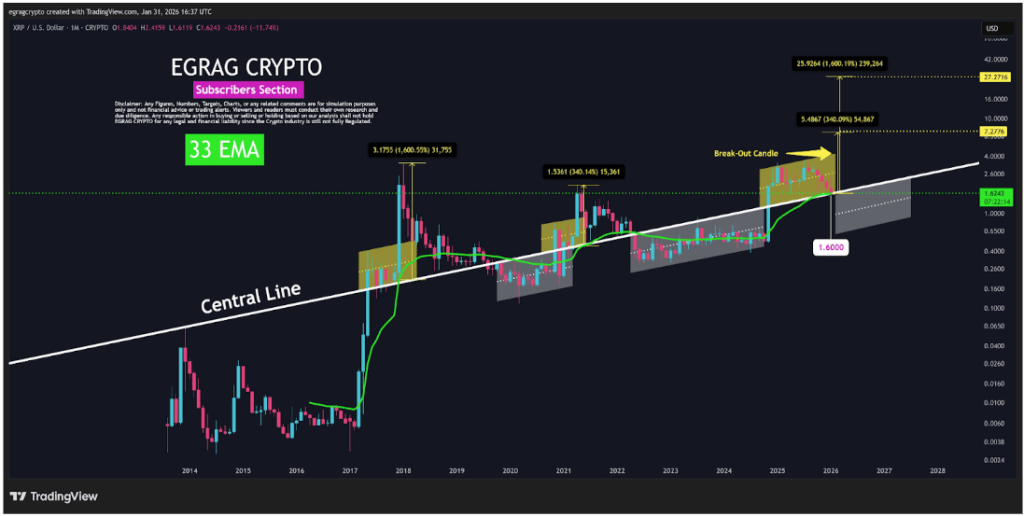

According to a technical analysis shared on X by crypto analyst Egrag Crypto, the recent drop below the 33-month moving average does not automatically indicate the end of the XRP cycle, but XRP should close above the vertical level to avoid macro bearish confirmation.

Related Reading

33 EMA breakout signal

At the time of writing, XRP is back to trading around $1.65, stable after a few hectic hours which forced many traders to re-examine the broader structure. However, according to technical analysis by Egrag Crypto, the most recent crash saw XRP break slightly below the 33 EMA on the monthly candlestick time chart.

Egrag is based on recent price action around one critical condition: the confirmed monthly close below $1.60 and the 33 EMA. According to the analyst, such a close would mark a major bearish confirmation based on historical structure, not sentiment or opinion.

The chart he shared highlights how XRP has respected the 33 EMA as a long-term trend reference throughout multiple cycles, violations of which often precede extended correction phases. As shown in the chart below, XRP price has been trading above the 33-EMA since early 2025, even during periods of correction. However, XRP is now trading dangerously close to this EMA, and there is now a downside risk.

XRP price chart. Source: @egragcrypto On X

What This Means for XRP Price Structure

There is a risk that XRP it can change to a the formation of the great bear. At the same time, there is reason enough to suggest the upward leap of cryptocurrency. A key point in Egrag’s analysis is the historical performance that shows that XRP’s strong expansion did not require a clean bull market.

So, there are two historical analogues of how XRP could play out from its current range around $1.60. The first is a repeat of the 2021 style movement. This move, measured against similar structural conditions, would mean an upside expansion of around 340% with a price target around the $7 region.

The second is a repeat of the 2017 cycle. Compared to the 2017 cycle projects a much larger structural expansion of about 1,600%, which would coincide with the $27 area highlighted in the chart above. In both cases, the rallies are from oversold conditions and pressure ranges, not from strong bullish confirmation as many would have expected.

Related Reading

Analytically, a break below $1.60 could still lead to panic selling and reinforce the fear narrative of a major bear market, yet those same conditions have previously been places where late sellers exited just before volatility peaked.

Featured image from Unsplash, chart from TradingView