Bitcoin Epstein Files: Is This Why Crypto Is Really Crashing?

A new batch of heavily redacted Jeffrey Epstein files has reopened an uncomfortable chapter in crypto history.

Emails cited by Epstein say he discussed Sharia-compliant digital currencies with unnamed Bitcoin founders in 2016, he said “I’m very happy.” Assertions are self-reported and not guaranteed.

However, Epstein’s personal logs list “satoshi (bitcoin)” as a guest at the UN Climate Week event, along with heavyweights like Larry Summers and Peter Thiel.

Time is dangerous:

- Reportedly, 74.79% of the development of Bitcoin core and code was done after Jeffrey Epstein took the top management role as the beneficiary.

- Later that year, he gave it to MIT staff who knew it was dirty money. They hide his name in the logs and inside they call him “Voldemort.”

- With Larry Summers: Epstein discussed the future of Bitcoin in his Manhattan mansion.

- With Brock Pierce: He caught the founder of Tether in a secret strategy session.

About three out of five Bitcoin core devs have been connected to Epstein since at least 2015. Here’s who else might be screwed in crypto:

FIND OUT: Top 20 Cryptos to Buy in 2026

Epstein and Coinbase? The COIN Investment That Refuses to Stay Buried

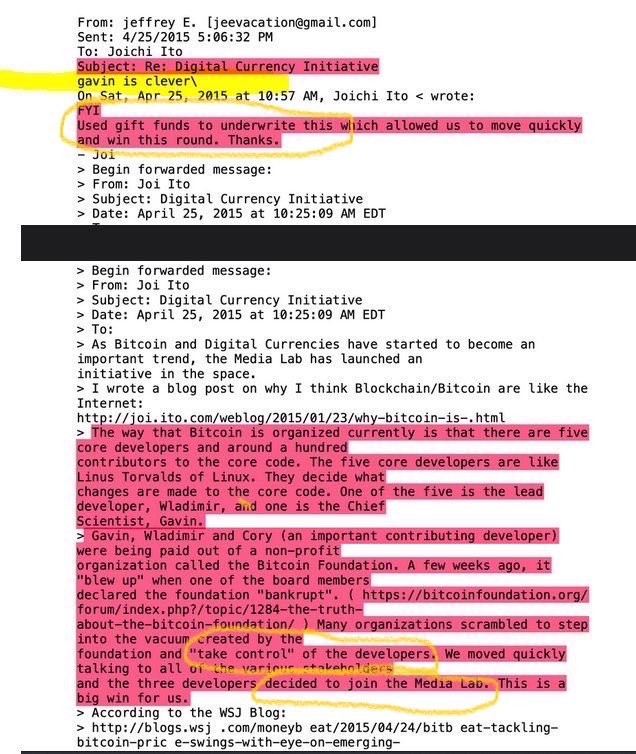

Records show that Epstein invested about $500,000 in Blockstream in 2014 through MIT Media Lab director Joi Ito, and later funded the development of Bitcoin Core during the financial crisis that same year, including the support of Gavin Andresen.

But he is also responsible for supporting Coinbase in its early days.

BREAKING: Jeffrey Epstein invested $3 million in Coinbase in 2014 at a value of $400 million, emails show. Fred Ehrsam knew, and the deal was arranged by Brock Pierce and Blockchain Capital. pic.twitter.com/H33bTJlVjw

– SwanDesk (@SwanDesk) February 2, 2026

Emails show that Epstein invested $3 Mn in Coinbase’s Series C in December 2014 at a value of $400 Mn, through IGO Company LLC. The same documents show that Fred Ehrsam knew the investment was being made for Epstein.

“I have a gap between noon and 3 pm today… it would be nice to meet him if possible.” – Fred Ehrsam, founder of Coinbase, email released by DOJ

That $3 Mn stake would be worth orders of magnitude today. Coinbase now holds a market capitalization of close to $51 Bn.

GET: The Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x by 2026

Epstein and Michael Saylor? A Close But Written Link

Reference to separate emails Michael Saylor, describing the $25,000 charitable donation that put him inside Epstein’s social orbit.

The book emphasizes how Epstein worked less as an investor and more as a point of contact, leverage and outreach across business, academia, and government. There is no evidence Saylor invested alongside Epstein or coordinated crypto work with him.

Michael Saylor was grilled by Epstein’s publicist Peggy Siegel who basically said

“He gets angry, I don’t know if I can take his money, I don’t know how to cheat him, he has no personality and he doesn’t understand how to behave in society.”

Michael Saylor is saved… pic.twitter.com/kE535vpkxW

– Autism Capital

(@AutismCapital) January 31, 2026

Bitcoin hit $78,000 in February 2026 and selling interest has died down. No new buyers, no momentum, just institutional money with $1.7 Bn in US ETFs while 106 million people worldwide hold BTC.

What is worth noting is that the centers are busy and the retail is not concerned. History suggests that this changed when demand came in, not enthusiasm.

DISCOVER: 20+ Next Crypto to Explode in 2026

What to Watch Next

Importantly, documentation is important for transparency, not price discovery. Who is spoiled? Who is not?

View additional unsubscribed releases detailing the level of early funding relationships. And how exchanges handle historical disclosures amid strict compliance rules.

The first crypto currency appeared everywhere, and sunlight, however late, is still needed.

Join the Utility Wave with BTC Hyper Now

CHECK: King of the Decade? Analyst Says Bitcoin Price Returns Will Beat Gold and Silver

Follow 99Bitcoins on X for Latest Market Updates and Subscribe to YouTube for Daily Expert Market Analysis

Key Takeaways

-

A new batch of heavily redacted Jeffrey Epstein files has reopened an uncomfortable chapter in crypto history.

-

By opening up Bitcoin to DeFi, gaming, and tokenized real-world goods, Bitcoin HYPER expands BTC’s use cases.

The post Bitcoin Epstein Files: Is This Why Crypto Is Really Crashing? appeared first on 99Bitcoins.