Ethereum Is Dying, Or Is This The Biggest Buy Signal Of The Decade?

Vitalik Buterin may have just killed the price of Ethereum and the L2 market. Buterin announced this week that “The original idea of L2s and their role in Ethereum is no longer logical.”

The idea in 2021 was that L2s would finally be distributed to people, but they haven’t really done that yet. It may not happen.

But Ethereum’s problems are much worse than that. The running joke is that the McChicken held since 2020 has won ETH. While other tokens hit higher, Ethereum is stuck below the 2021 peak. Something broke.

GET: The Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x by 2026

Is Ethereum Worth Buying In 2026? Is Vitalik mining tons of ETH

Change is a cost. After developments like Dencun, the average transaction fee on Ethereum has dropped to cents, often below $0.01. With further increases in the gas limit expected this year, the original pitch of L2s as saving “brand shards” has weakened.

At the same time, the expansion of the state in many L2s has stopped. Some groups have halted development for regulatory or commercial reasons, undermining the idea that they are inheriting a clean legacy of Ethereum’s security.

If you’ve held McChicken for the past 5 years, you’ve been successful in Ethereum. pic.twitter.com/u6AYm1yX7i

— Uzi (@UziCryptoo) January 31, 2026

Meanwhile, Vitalik lost 1,441 ETH, $3.3 Mn, in the last two days. On-chain data has found it, however speculation points to the contributions it makes.

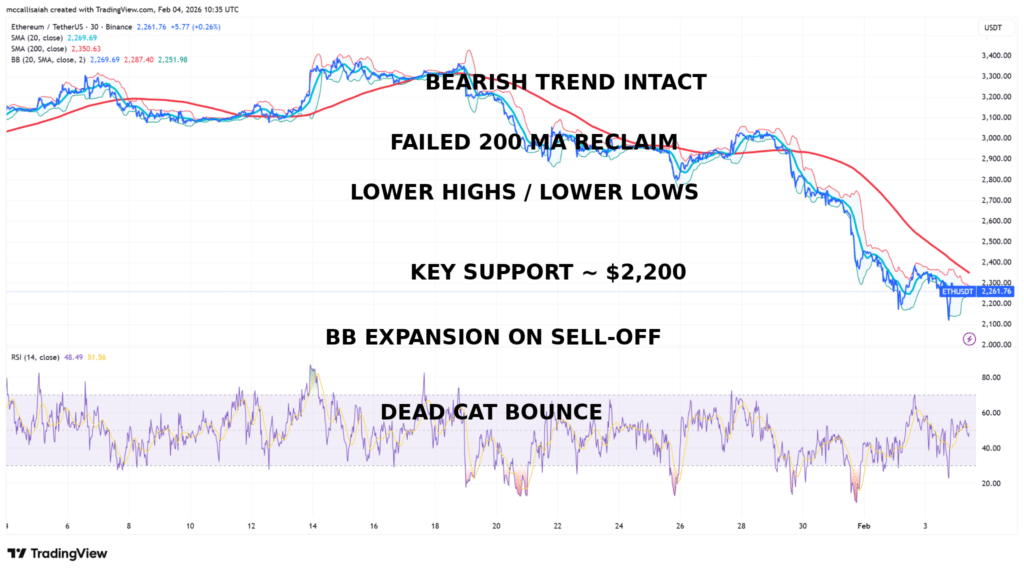

The ETH chart is textbook bearish: lower highs, lower lows, each bounce weaker than the last. The recent rally looks like a jumping dead cat with support at $2,200, then $2,100.

Ethereum is still in the market. Until the price regains the 200 MA with certainty, this remains a bearish structure with a low risk that remains realistic.

DISCOVER: 20+ Next Crypto to Explode in 2026

What Does the Data Say About the Ethereum Price Right Now?

Several other metrics point to a bearish year for Ethereum:

- The supply of ETH increased by 45,000 tokens every month for the last 10 months until January 2025. The narrative of deflationary burning is dead.

- Layer 2 activity has improved but mainnet revenue has fallen.

Additionally, record transactions look suspicious, with 99Bitcoins analysts flagging multiple spam attacks, not organic growth.

“The Ethereum L2 roadmap is a catastrophic failure.” – Max Resnick, Lead Economist, Anza

TVL’s dominance decreased from 14.6% to 12.8% by the end of 2025. Material is perishable.

FIND OUT: Top 20 Cryptos to Buy in 2026

What to Watch Next for ETH USD

View proposals on indigenous integration and gas cap increases. Track which L2s express clear guarantees versus vague measurement promises.

Ethereum chooses payment complexity over growth in any way, and that choice will reshape which networks survive in the next cycle.

CHECK: King of the Decade? Analyst Says Bitcoin Price Returns Will Beat Gold and Silver

Follow 99Bitcoins on X for Latest Market Updates and Subscribe to YouTube for Daily Expert Market Analysis

Key Takeaways

-

Vitalik Buterin recently admitted that the plan failed. He declared that the L2 strategy was dead and the price of Ethereum was fixed.

-

The supply of ETH increased by 45,000 tokens every month for the last 10 months until January 2025. The narrative of deflationary burning is dead.

The post Is Ethereum Dying, or Is This the Biggest Buy Signal of the Decade? appeared first on 99Bitcoins.