Bitcoin Flashes Lunar-Level Relocation Signal at $67K, Not $19K

Bitcoin is printing on-chain losses at the rate last seen during the Luna/UST meltdown, but at a very different price point, the difference that changes what the signal means for this decline.

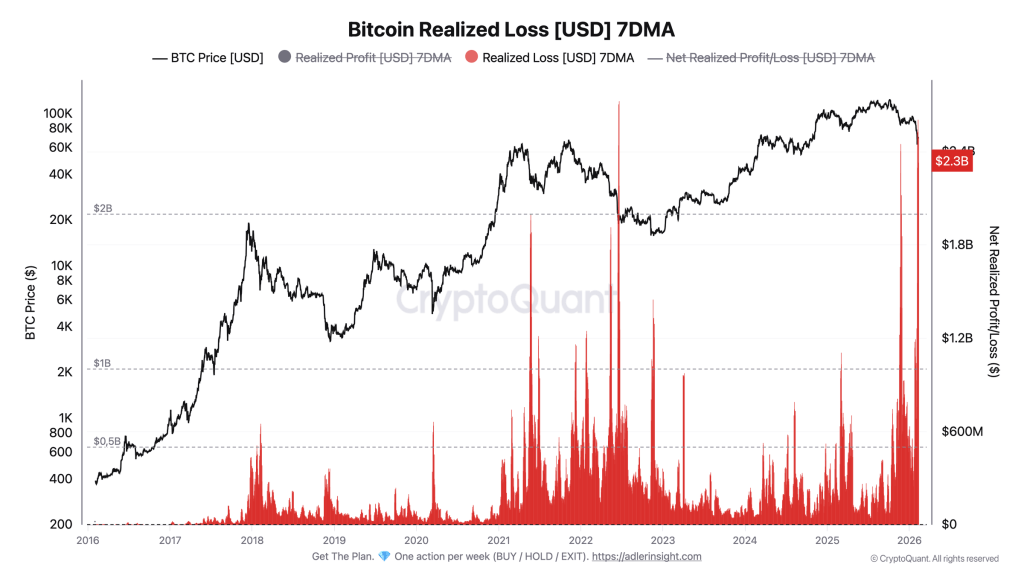

Axel Adler Jr. said Bitcoin’s Net Realized Profit/Loss plunged deeper into negative territory, with the 7-day moving average falling to $1.99 billion on Feb. 7 before improving slightly to $1.73 billion in Feb. 10. That puts the current regime among the heaviest losses on record. Adler described it as “the second worst reading in all of visual history,” only surpassed on June 18, 2022, when the metric reached $2.24 billion amid the Luna/UST crash and liquidation.

The key detail, Adler argues, is persistence. Net Realized Profit/Loss stayed below about $1.7 billion for five consecutive days, forming what he did as a continuous collection of sellers’ pressure, the kind of multi-day pressure that usually marks capitulation behavior instead of a single print of shock.

In Adler’s framing, the mechanic is straightforward: realized losses dominate profits from converted coins, and the market operates by supplying participants who are forced or willing to sell below their cost base.

Related Reading

“The depth and duration of the current bad regime points to a large concentration of participants who bought coins at high levels,” he wrote. “The main trigger for the pullback is the return of Net Realized Profit/Loss above zero, which would indicate a market shift from loss control to profit control. As long as the metric remains in deeply negative territory, bearish pressure continues.”

Bitcoin Losses Match Luna Crash Scale

A companion chart, Bitcoin Realized Loss (7DMA), shows realized losses rising to nearly $2.3 billion in Feb. 7 and held close to that level on Feb. 10, another rarity in a historical context. Adler called it “one of the smoothest levels in the entire history of observation,” clearly comparing it to June 2022.

He also emphasized that the 7-day smoothing understates the high pressure in real time. At the height of the 2022 episode, Adler noted, the one-day loss was nearly three times the smooth weekly figure. In the current window, he referred to a one-day loss of $6.05 billion in Feb. 5, the second largest one-day loss in Bitcoin history, according to his note.

The subject comparison, however, is not just size but setup. In 2022, the same regime of losses occurred with bitcoin trading at around $19,000. In this case, Adler says, the loss is generated at about $ 67,000 after retreating to $ 125,000, the context that he puts as a correction that removes late entries instead of an ecosystem-wide failure.

Related Reading

“During that period, the Realized Loss of $2.7B occurred at a price of $19K,” Adler wrote. “Now, the relative loss is locked in at a price of $67K, suggesting not a planned crash but rather a late bull cycle entry exit. This is a collection of top local buyers, not a loss of network value.”

Adler’s playbook puts two markers front and center. The first is the continuous movement of the Net Realized Profit/Loss (7DMA) back above zero for several weeks, which it marks as a transition from loss control to profit control. The second is the drop in Realized Loss (7DMA) below $1 billion, which would indicate that the wave of forced or pain-driven selling is ending.

The risk, in his view, is that the market’s “cleansing pressure” turns into something final if price weakness converges. Adler flagged the area below $60,000 as a line where continued growth in losses found alongside continued price declines could turn a correction into “full consideration”, not because the current documents are small, but because the regime can expand and deepen.

At the moment, Adler’s main claim is that Bitcoin generates loss signals equal to Luna without the same structural damage as Luna. Same order of magnitude in chain, different story in tape.

At press time, BTC traded at $67,924.

The featured image was created with DALL.E, a chart from TradingView.com