Mercer Q4 2025 Earnings: Big Pharma Growth Shocking

Mercer International (NASDAQ: MERC) Mercer’s Q4 2025 earnings show the company is dealing with pulp market conditions. The company posted Q4 revenue of $449.5 million. Also, management has made progress on its cost-saving plan. The plan aims to reduce costs by $100 million by the end of 2026.

Mercer Q4 2025 Earnings: Revenue Results

Revenue for Q4 2025 came in at $449.5 million. This marks an 8% decrease from $488.4 million in Q4 2024. Also, the pulp segment brought in $371.2 million. Meanwhile, hardwood products added $82.7 million. Also, business activities provided an additional $1.9 million.

In the full year of 2025, revenue reached $1.868 billion. Therefore, this was 9% less than $2.043 billion in 2024. However, management noted gains on a quarter-to-quarter basis.

Chart: Mercer Q4 2025 Earnings – Quarterly Revenue Trend

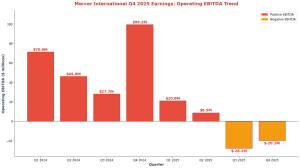

Mercer Q4 2025 earnings: Operating EBITDA review

EBITDA performance in Q4 2025 was negative at $20.1 million. But, this beats the negative $28.1 million in Q3 2025. So, the $8 million profit shows progress. By 2025, Operating EBITDA was $22.0 million. In contrast, in 2024 he sent 243.7 million dollars.

The pulp segment had EBITDA of $11.3 billion. Also, hardwood shipped $10.8 million. In fact, the painful consequences of the hardwood pulp downcycle. Also, high fiber costs in Germany weigh on the limit.

Chart: Mercer Q4 2025 Earnings – Operating EBITDA Trend

Cost Savings Plan On Track

The “One Hundred Goal” program continues. So far, the company has saved about 30 million dollars by 2025. Therefore, the 100 million target by the end of 2026 remains on track. Also, this savings will help in future market cycles. Also, additional cost reductions are available.

Mass Timber Gains Momentum

The large timber business continues to grow. In fact, the order book reached $163 million. This includes projects in Germany and North America. Now, the Spokane plant aims to open in the first half of 2026. Therefore, the dose will increase once you start.

Meanwhile, large logs give way to growth. Also, green building trends are increasing long-term demand. So, this business adds diversity.

Cash Position Remains Strong

Revenue stood at $186.8 million at the end of the year. Also, cash on hand was around $430 million. In fact, cash flow increased by $76 million from Q3. Therefore, the company has a place to work. In addition, the loan payments are well distributed.

Non-Cash Expenses Recorded

Q4 2025 had $238.7 million in non-cash payments. Of this, $174.0 million was for Peace River pulp. Also, $64.7 million was for Celgar mill supplies. Therefore, these costs reflect market conditions. But, it doesn’t affect the cash.

The total loss for Q4 2025 was $308.7 million. Apart from the cost, the loss was very little. By 2025, total losses reached $497.9 million.

Market Outlook

Hardwood pulp markets are in a down cycle. But, supply trends suggest stability ahead. Also, the need for packaging remains the same. Also, tissue markets show staying power. Thus, the market’s rise supports future results.

In Germany, fiber costs remain high due to regulations. However, cost cutting is weathering these storms. Overall, the shape of the cycle should improve.

For more details, see Mercer International’s Q4 2025 earnings report on the company’s investor relations page. Also visit Yahoo Finance MERC for stock data.

Click Here to visit the AlphaStreet website.