Bitcoin’s Death by a Thousand Cuts: Why the Current Volatility Is the Ultimate Test for the HODLer

Sounds like the sky is falling again, doesn’t it? If you’ve been watching the charts lately, you’ve seen the price of Bitcoin slide sharply into 2026, testing the nerves of seasoned veterans. We are currently looking at a low of $60,000, a far cry from the euphoria of the $100,000 highs we saw not too long ago.

But according to industry experts, this is not a catastrophic crash; it is a stress test. Anthony Pompliano, founder of Professional Capital Management, recently described this pullback not as a sudden heart attack, but as “death by a thousand cuts.” It sounds sad, but for those using a long-term strategy, this could be the most important buying opportunity of 2026.

The macro environment is important for bitcoin investors to understand now.

Wall Street is here, so you have to pay attention to what they think and do. pic.twitter.com/OJJhoX479l

– Anthony Pompliano (@Ampompliano) February 13, 2026

Why This Bitcoin Price Volatility Matters to Investors

So, why is the market bleeding? Speaking on CNBC, Pompliano emphasized that there is not a single criminal in this story. Rather, it is a combination of four smaller elements. First, we take a natural profit after Bitcoin finally breaks the psychological barrier of $100,000 in a normal cycle. Second, investors now have “more on the buffet” with the rise of AI stocks, stealing the crypto limelight, and a new burst of gold highs.

Importantly, the narrative is changing. While many of us buy Bitcoin as a hedge against rising currency rates (to protect against a losing dollar value), Pompliano argues against that. deflation now it is a major economic risk. This change creates temporary confusion in the market.

However, he notes that Bitcoin’s volatility is actually depressing as the asset grows. He calls it “an 80-volt supply that turns into a 40-volt supply.” Basically, price volatility becomes less and less over time, even if it still feels like a rollercoaster ride to us.

However, at the moment, the sentiment of the crypto market has hit the bottom. We see Crypto Fear and Greed at 6-year lows, suggesting that fear is the dominant emotion right now.

Crypto Chart of Fear and Greed

1 year

1 m

1 w

24h

FIND: 16+ New and upcoming Binance listings in 2026

What the Data Really Shows About the Bitcoin Price Slide in 2026

The numbers support the “death by a thousand cuts” theory. We don’t see the structural failure of the Bitcoin network; we see market mechanics at work. The introduction of ETFs has made Bitcoin “financialized,” meaning it now trades like a common commodity and less like the western currency it once was.

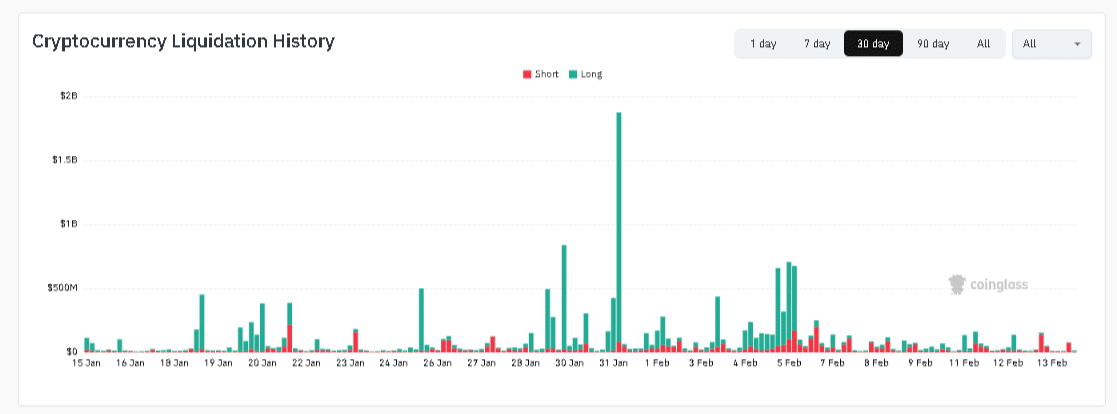

This latest slide is primarily a claim of “reduction without capitulation”, according to VanEck. Explained in plain English? Traders who use leverage (profit) get washed, but long-term believers don’t.

(Source – Crypto Liquidations, CoinGlass)

Data from Coinglass shows billions of liquidations, contributing to the fear-mongering that has accelerated in recent weeks. However, Pompliano points out that compared to previous bear markets, this cycle has seen a slight reduction from the upside. The floor is rising, even if it feels like the floor is slipping out from under you today.

FIND OUT: Top 20 Cryptos to Buy in 2026

Is ‘Extreme Fear’ Actually a Buy Signal for Bitcoin Price?

For beginners, this is the hardest part: doing the opposite of what your gut tells you. When all others panic, the opposite move is to look for opportunity. This is where the HODL (Holding On for Dear Life) strategy is truly tested.

Historically, buying Bitcoin when the Fear & Greed Index is at “Extreme Fear” (below 20) often leads to significant returns a year later. That is why great analysts still maintain high standards. For example, we still see similar climate models Bernstein’s Bitcoin price of $150k in playing despite the darkness that exists.

In fact, while retail investors are panic selling, on-chain data suggests that institutions are buying the dip in ETFs. As Kraken’s market notes note, flexibility is the price you pay for performance.

What You Can Watch Next: Look at the $60,000 level and the Fed’s announcements on interest rates. The market is scared, but that’s when smart investors start paying attention.

FIND OUT: How to Buy Bitcoin for Beginners

Follow 99Bitcoins on X (Twitter) and YouTube for daily updates.

The post Bitcoin’s Death by a Thousand Cuts: Why the Current Volatility Is the Ultimate Test for the HODLer appeared first on 99Bitcoins.