Glencore shares soar 145% in 10 months – but could this blistering rally have just begun?

Image source: Getty Images

Glencore (LSE: GLEN) shares have rallied since ending last April after the Liberation Day sell-off. Now the business has returned to profitability and has unveiled bold plans to become the world’s largest copper producer. So could the stock be on the verge of a major market re-rating?

2025 results

Full-year results from the mining giant suggest a turnaround rather than business weakness. Adjusted EBITDA fell 6% to $13.5bn – below the peak of $34bn during the 2022 energy shock – but statutory profit for the year returned to a smaller $0.4bn, marking a return to statutory profit.

The momentum was much better in the second half. EBITDA jumped 49 percent compared to H1 as steel prices firmed, gold smelting and copper production increased nearly 50 percent.

The drag remains coal, with heating and steel prices down more than 20% by 2025, weighing on profits.

Shareholders are still being paid to wait. The 10¢ base spread is unchanged, but the 7¢ top-up – funded by the newly counted Bunge stake – increases payout by 2026 to $2bn, and translates into a 3.4% dividend yield.

Power change

What remains prominent is Glencore’s place at the intersection of dying fuels and revolutionary metals. Coal prices may be weak now; but in the mining industry the solution to low prices is low prices.

Mining is going through cycles, and supply is already responding. In Australia, manufacturers are cutting production as margins disappear. At the moment, demand is not going away – it’s changing. Developed markets may be cutting back on coal, but emerging economies still need more and less expensive energy to grow.

If supply tightens while developing world demand remains strong, could today’s weak coal prices halt tomorrow’s rebound?

Copper

More than $10trn has been poured into renewables over the past two decades, yet fossil fuels still provide nearly three-quarters of the world’s energy.

The next one is even bigger. Around $300trn could be spent over the next 20 years to electrify transport and energy, develop grids and scale AI – all of which will require a staggering amount of copper.

There is no shortage of copper in the soil. The bottle takes it out. Allowing for delays, labor shortages and industry vigilance means new supply is struggling to keep up with future demand.

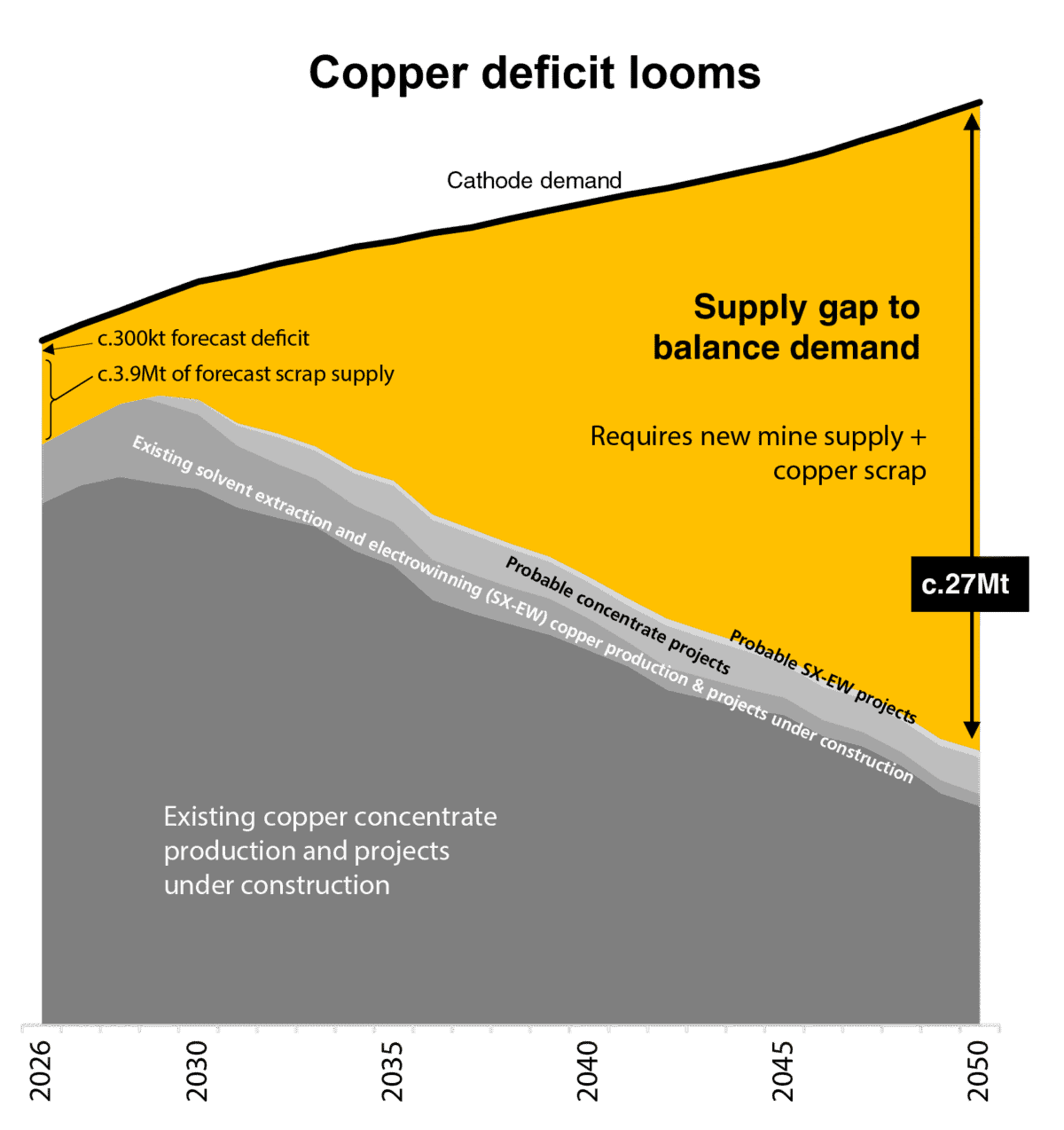

The chart below shows just how tight the market could be: internal estimates suggest the global copper shortage could reach 27m tonnes by 2050.

Source: Glencore

Accidents

Execution risk, not prices, could prove the biggest test for Glencore. The latest withdrawal from the proposed mega merger with Rio Tinto after the failure to agree on terms shows how difficult it is to judge long-term value in a deeply cyclical industry.

At the same time, future growth depends on bringing large copper projects online. To manage that risk, it is looking for joint venture partners for long-term greenfield development. The balance is fragile: grow too fast and returns suffer; go too slow and the lack of structure can pass.

What is the decision?

I have long believed that the best opportunities arise during times of greatest pessimism.

The last few years have tested the patience of shareholders, but all the while Glencore itself has been buying up its own undervalued shares. Now profits are stabilizing, metal pressure is increasing, and the strategy is aligned with the next commodity cycle. If feelings change even slightly, the potential for rebalancing can be great. Worth considering? I think so.