No More CME Gap? CME Group Launches 24/7 Trading

CME Group is going full crypto mode. Starting May 29, 2026, it will offer 24/7 trading of its crypto futures and options. There are no more weekend vacancies. No more waiting for traditional market hours.

The move closes the gap between Wall Street’s schedules and the ever-present nature of crypto. And it comes as demand for the facility continues to hit records.

Traditional finance is finally catching up with the speed of crypto.

The crypto market never sleeps. Now, your risk management shouldn’t happen either.

24/7 trading in Cryptocurrency futures and options is coming May 29*, so you can manage your risk when you need to.

See what’s changing.

*Pending regulatory review pic.twitter.com/i6xjkJVffm

– The CME Group (@CMEGroup) February 19, 2026

DISCOVER: The Best New Cryptocurrencies to Invest in 2026

End of the Weekend Gap

For years, there was a strange conflict.

Bitcoin trades 24/7 on existing exchanges. But CME futures will close over the weekend. Thus was born the famous “CME gap”. The price would go up while Wall Street desks went offline, then reopen in a flash.

No more CME gap kid

– Crypto Kid (@CryptoKid) February 19, 2026

The big players had to watch from the sidelines between Friday and Sunday while crypto kept moving.

That dynamic is about to disappear. With futures trading 24/7, institutions can hedge risk at any time, just like retail traders do. There are no forced breaks while the market is active.

FIND OUT: Top 20 Cryptos to Buy in 2026

Institutional Appetite Hits Record Levels

This is not about being free. It’s about scale.

CME says the demand for risk management is very high. By 2025 alone, it has processed a volume of $3T. That’s a tough size.

Daily volume increased 47% year-over-year, averaging over 403,900 contracts. And it’s not just Bitcoin and Ether. The list now includes Solana, XRP, and new contracts for Cardano, Chainlink, and Stellar.

Retailers may watch IBIT options for hype. Institutions looking to the future open interest. This is where the real power resides. Metrics like Cardano’s open interest reveal the level of risk built into the system.

Bitcoin ownership has changed dramatically in 2025.

More in next week’s report on Bitcoin adoption. pic.twitter.com/dyIk9e7rWt

— River (@River) February 17, 2026

With 24/7 access, big players no longer have to fear weekend trips they can’t afford. They can manage exposure in real time.

Could This Reduce Bitcoin Price Volatility?

For ordinary investors, this cuts both ways.

Weekends used to mean less economy. That’s why we got those wild changes and random scam threads. Since CME is open 24/7, the money should be deep. That would alleviate some of that chaos. Some even argue that this is another step towards a mature, stable Bitcoin market.

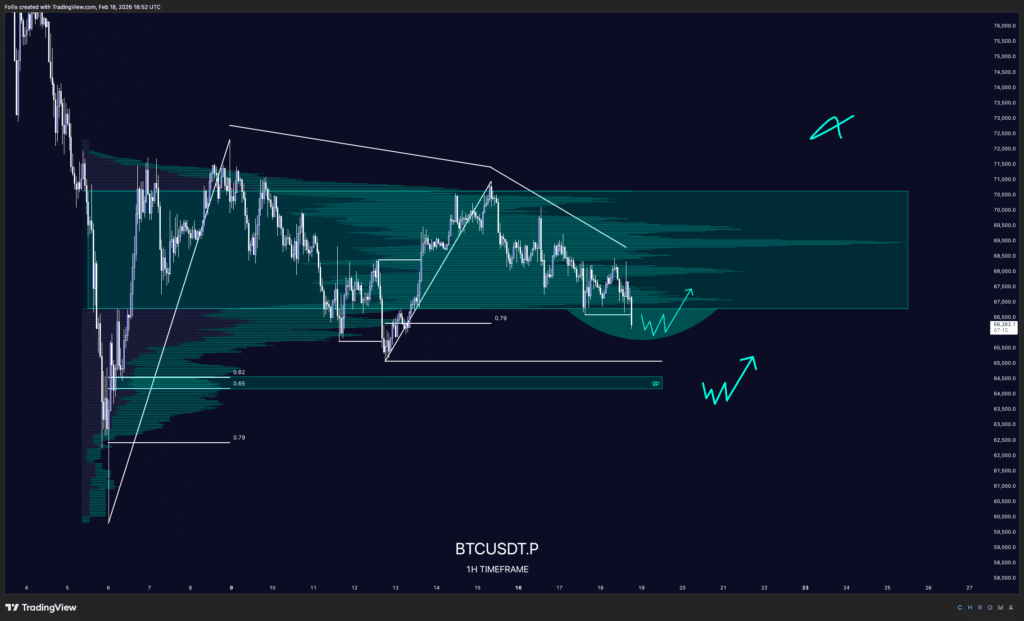

(Source: BTCUSD / TradingView)

But slow down.

If institutions can trade at 3 am on a Sunday, they can react quickly to the headlines. That can reduce gaps while speeding up movement. Volatility never ends. It just evolves.

If the moderators close, this will go live in late May. And that marks a real change in the way Wall Street treats crypto.

FIND: Top Solana Meme coins to buy in 2026

Follow 99Bitcoins on X for Latest Market Updates and Subscribe on YouTube for Daily Expert Market Analysis.

The post No More CME Gap? The post CME Group Launches 24/7 Trading appeared first on 99Bitcoins.