80 Gold Advans Recapitalization Plan As Project Development Continues

80 Gold Corp (NYSE: IAUX ) closed at $1.95, down 10.6% in the latest session following its fourth quarter 2025 earnings release. Market capitalization: $1.61 billion.

Latest Quarterly Results

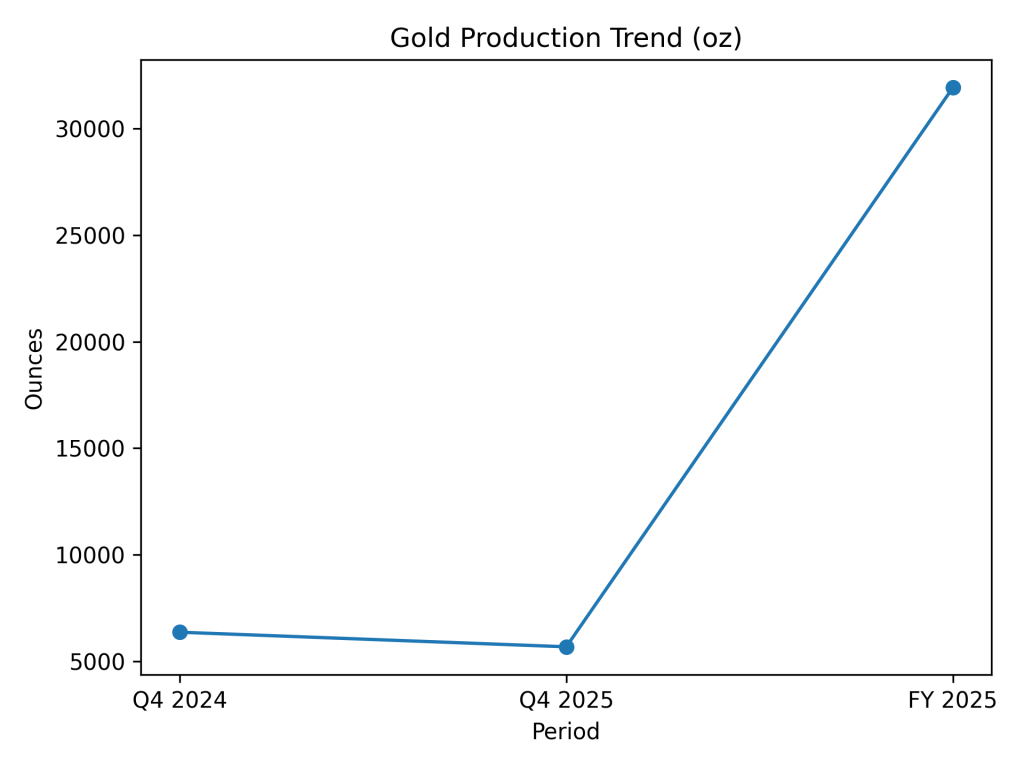

Revenue for the quarter reached $21.3 million, compared to $23.2 million in Q4 2024, representing a year-over-year decrease of 8.3%. Net loss widened to -$85.6 million from -$17.7 million last year. Adjusted loss was $-37.8 million compared to $-25.0 million in Q4 2024. Gold production was 5,674 ounces compared to 6,359 ounces in the year-ago quarter. Cash and cash equivalents stood at $63.2 million at the end of the year.

Summary of Full Year Results

For the year ended December 31, 2025, revenue increased to $95.2 million, reflecting increased gold prices and higher production compared to 2024. FY2025 gold production reached 31,930 ounces. Net loss for the year expanded primarily due to non-cash fair value adjustments and development costs.

Year-on-Year Comparison (Q4 2025 vs Q4 2024)

| Metric | Q4 2024 | Q4 2025 | YY Switch |

| Revenue ($M) | 23.2 | 21.3 | -8.3% |

| Total lost ($M) | -17.7 | -85.6 | nm |

| Adjusted loss ($M) | -25.0 | -37.8 | 51.1% |

| Gold production (oz) | 6,359 | 5,674 | -10.8% |

Business & Operations Update

The company completed a Class 3 engineering study for the renovation of the Lone Tree autoclave, confirming a processing capacity of 2,268 tons per day and an estimated cost of $430 million. The Granite Creek underground operations progressed with drainage and development activities, while the Archimedes surface operation began during the quarter. More than 6,500 ounces remained in stock at the end of the year pending third-party processing.

Financial trends

Active Performance – Income Style

Active Performance – Gold Production Style

IM&A or Strategic Moves

Management announced a secured financing package of up to $500 million, including a $250 million royalty provision and a $250 million gold prepayment facility. The proceeds are intended to retire existing debt, pay for Lone Tree renovations, and support exploration and operating expenses.

Equity Analyst Commentary

The agency’s research highlighted financing and project delivery as important aspects of monitoring. Analysts focus on the adjustment of the capital structure and operating timelines.

Direction & Outlook

By 2026, management is targeting Granite Creek production of 30,000–40,000 ounces and approximately 10,000 ounces from the Archimedes and residual operations. Operating cost guidance for Granite Creek ranges between $110–$120 million. The cost of growing a Single Plant is estimated at $140–$160 million.

Performance summary

Shares declined on the day of the announcement. Quarterly revenue is down year-over-year, while full-year revenue is up. Net loss was widened due to non-cash items and related developments. The financial restructuring package and project development initiatives remain the focus of near-term operations.