£1,000 buys 198 shares in this FTSE 100 investment trust which has returned 25% per annum over the last 10 years.

Image source: Getty Images

10 years ago, the FTSE 100 The index has returned slightly less than 9% for the year when dividends are included. That’s not a bad return.

However, investors would do much better with an investment trust that is part of an index. Over the last ten years, this particular product has returned about 25% per year.

A good long-term investment

This is the one I am referring to Polar Capital Technology Trust Company (LSE: PCT). This is a tech stock-focused product owned by a London-based investment manager Polar capital.

Ten years ago, it was trading at around 55p. Today however, it has a share price of around 503p.

That means anyone who bought 10 years ago and held for a long time made nine times their money. That’s a fantastic return – it would have turned a £5,000 investment into around £45,000.

Is it worth looking at in 2026?

Is this trust worth considering today? I think so.

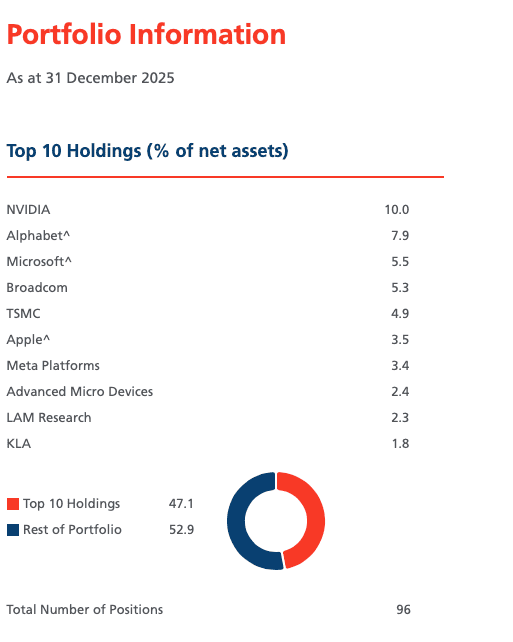

The table below shows the top 10 holdings by the end of 2025. What I like about that list is that there is a lot of exposure to the chip (Nvidia, Broadcom, AMD, TSMC) and shares of chip manufacturing equipment (Lam research, The KLA).

I think these stocks will do well in the coming years. They should benefit as companies like Amazon, Alphabetsagain Meta spend more on AI infrastructure and the world becomes digital.

Deeper into the holding, there were some really interesting names in the portfolio at the end of October (latest full portfolio holding data available). Some examples here include the taser maker Axon CompanyAI powerhouse Palantirdata center cooling specialist Vertivand the fastest growing investment platform Robinhood Markets.

Yes, there are many chances that these names will be sold from the end of October. But it shows you the types of innovative companies in the portfolio.

Another thing to like about this trust is that it is currently trading at a discount of almost 10% to its net asset value (NAV). In other words, anyone who buys now gets access to a basket of high-quality technology stocks at a significant discount.

Risks and payments

Of course, there are a number of risks to consider with this product. Another industry focus.

While the portfolio is highly diversified at the stock level, it is not highly diversified at the sector level (although there are a few stocks in the portfolio that are not pure technology stocks). Therefore, if the technology sector were to melt down (or go nowhere), this trust would not work well.

Significant exposure to chips is another risk to consider. This area of technology has historically been in flux.

In terms of fees, the rates are constant at 0.77%. That is very high.

There are other products in this space that have lower costs. An example here is iShares S&P 500 Information Technology Sector UCITS ETF (its fees are just 0.15%).

Overall, I see little appeal in this product. I believe it is worth considering a diversified portfolio.