Caroline Ellison Freed After 440 Days – FTX Victims Are Returned?

Former Alameda Research CEO Caroline Ellison left the state’s custody after 440 days, closing one of the most visible chapters of FTX’s downfall. Crypto prices barely moved on the news, which tells you something important: the markets have already priced themselves into a legal collapse. The big story now sits off the charts, inside the courts and the loan sharks.

This release comes as the crypto is facing intense scrutiny and a lengthy purge from the 2022 exchange boom. Regulators still point to FTX as a reason for the rules to change. And everyday users still feel the scars.

CAROLINE ELLISON FIRED AFTER 440 DAYS ON THE WORK pic.twitter.com/Uy2rMVv1lA

— 0xMarioNawfal (@RoundtableSpace) January 21, 2026

FIND OUT: Top 20 Cryptos to Buy in 2026

What Happened – And Why Caroline Ellison Matters

Ellison ran Alameda Research, a trading firm closely tied to FTX. Prosecutors indicated that Alameda used customer funds from FTX to cover the losses. Ellison admitted his role and cooperated with authorities, which helped secure the conviction of Sam Bankman-Fried.

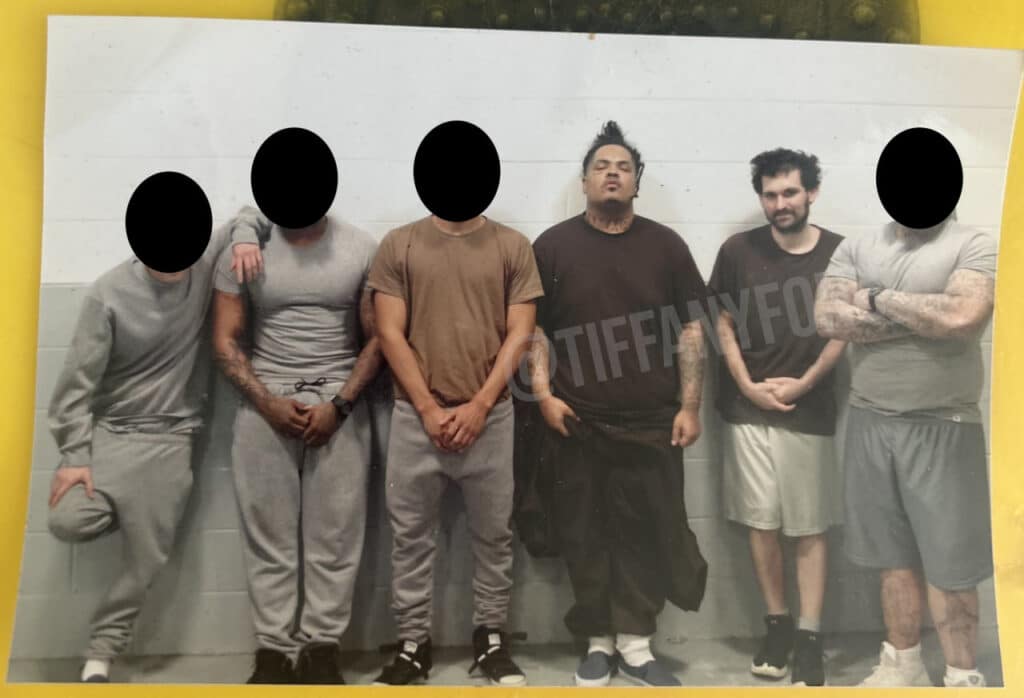

(Source: Sam’s Official Jail Photo / NYPost)

That cooperation was important. It shortened his sentence and led to his release, and Bankman-Fried he’s turning 25 and getting ready to hear the appeal in November 2025.

Ellison also agreed to a 10-year ban from serving as an officer or director of public companies or crypto exchanges. That ban prevents any quiet financial return.

FIND: Top Ethereum Meme coins to buy in 2026

How Does This Directly Relate to FTX Fees

If you lost money on FTX, this is the part that hits your wallet. Ellison’s testimony helped unlock assets and map where the money went. That duty goes directly to the recovery of creditors.

So far, bankruptcy trustees have returned $7.1 billion to creditors in three payment rounds through 2025. The next distribution is scheduled for January 2026.

For starters, think of this as a messy business bankruptcy. The more clearly investigators follow money, the more money ends up returning to clients instead of being stuck in legal limbo.

Caroline Ellison has been released from prison again $FTT it doesn’t move at all. The canals are really dead. pic.twitter.com/craBKbMZcJ

— Manta (@MantaRayCapital) January 21, 2026

Why Regulators Are Still Targeting FTX

Ellison’s release does not mean the story goes away. Lawmakers and regulators still use FTX as an example when pushing for stronger exchange rules. Maintenance, auditing, and prevention of conflicts of interest all take a back seat here.

This is important even if you have never touched FTX. Strict rules shape how exchanges operate, what assets they list, and how your funds sit on their balance sheets. Less freedom of exchange usually means more security for users.

It also explains why many long-term crypto users switched to self-storage after 2022. Holding your keys removes the risk of currency exchange, but also means full responsibility.

FIND: Top Solana Meme coins to buy in 2026

Follow 99Bitcoins on X for Latest Market Updates and Subscribe to YouTube for Daily Expert Market Analysis

Why you can trust 99Bitcoins

Founded in 2013, 99Bitcoin team members have been crypto experts since the early days of Bitcoin.

90+ hours

Weekly survey

100k+

Monthly students

50+

Professional contributors

2000+

Crypto projects reviewed

Follow 99Bitcoins in your Google news feed

Get the latest updates, trends, and information delivered right to your fingertips. Register now!

Register now